how commodity trading works margex crypto

Pre

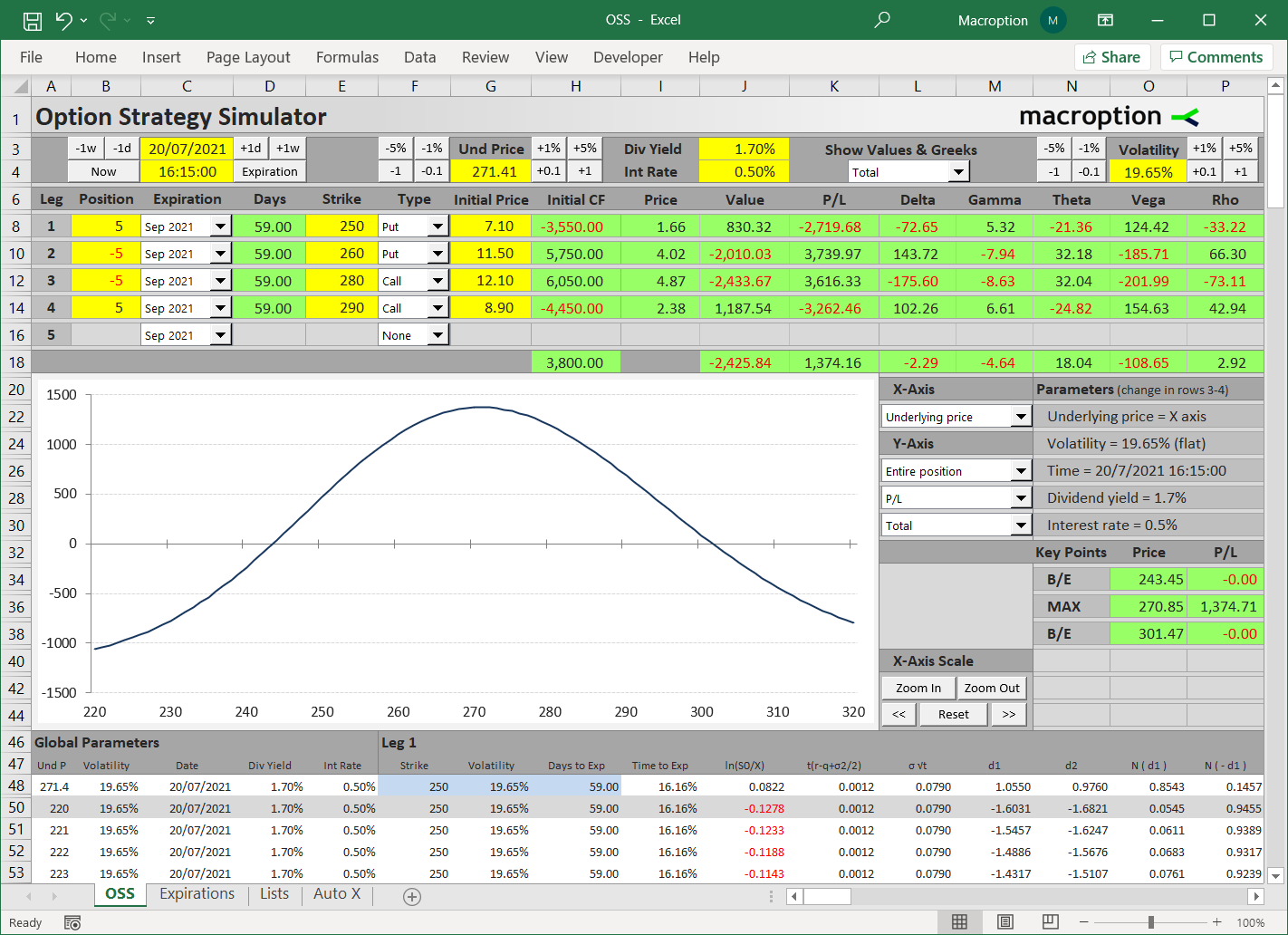

Option Strategy Simulator - Macroption 1422 x 1032

Margex a privatized margin that acquaints the crypto trader with the desired funding fees and liquidation price. Security From Price Manipulation Trading pairs with high leverage trading can be a perilous affair due to its extremely volatile nature.

Commodity trading involves different types of contracts that derive their value from the underlying commodity. In India, commodity contracts include spot, futures, and options contracts. In spot.

How Commodity Trading Works? 1. Opening a Commodity trading account and getting it approved:. The first step in understanding how commodity trading. 2. Margin Money:. The trader also has to deposit the initial margin amount into the account as soon as the account is. 3. Order Processing:. Once .

Margex is a cryptocurrency derivatives trading platform, meaning they offer only derivatives of the underlying assets and not the assets themselves. Some of their most notable aspects include: Up to 100x leverage. For traders who know their way around a market, this offers the chance to potentially increase their profits a hundredfold.

How Commodity Trading Works Step-by-Step Detailed Tutorial

Margex Exchange Reviews 2021 - Is It Safe To Use? Cryptogeek

Margex is a cryptocurrency exchange registered in the Seychelles. It has been active since 2020. Margex Advantages On its website, Margex highlights the following factors as main advantages with its platform: privacy, secure trading and transparency. These factors are all important of course. Affiliate Program Margex has an affiliate program.

Margex – Trade ₿ Bitcoin With up to 100x Leverage Crypto .

Margex review - Crypto Leverage Trading Platform - Cryptostec

Ironbeam Futures Contracts - Brokerage Account

Trade Nearly 24hrs a Day - VIX® Index Options - cboe.com

Build a Crypto Portfolio - #1 in Security Gemini Crypto

Margex is a crypto exchange focused on derivatives trading and leveraged trading. The platform is characterized by easy navigation and interface, rich functionality, low fees, and a decent level of security which is especially critical for a platform dealing with money and personal data.

Section B HOW COMMODITY TRADING WORKS

Margex – Reviews, Trading Fees & Cryptos (2022) Cryptowisser

International Index Fund - Invest With Green Century

Margex Review: Crypto, Trading & Fees hedgewithcrypto

How Commodity Trading Works - Cannon Trading

Margex derivatives exchange supports trading the 5 major crypto assets such as BTC, ETH, LTC, XRP, EOS and YFI. Each futures contract is traded against the USD pair using Bitcoin as collateral. The number of pairs is quite limited, however, these are currently the most popular derivatives pairs to trade. Pricing & Fees

Margex Review 2022: Is It Trustworthy?

The liquidity system that Margex offers is unique and only one of its kind in the industry of crypto. Margex combines the liquidity from 12+ best liquidity providers of the world into one deep order book. This feature allows minimum slippage, deep liquidity, best entry and exit prices, thinner spreads, and instant order execution.

Margex is a true refreshment in the crypto derivatives space. The platform offers low fees, high leverage and security standards. 8.5/10 Rene Peters captainaltcoin.com Margex is a solid exchange for beginners that want to learn how to trade with leverage. There are no complicated features or distractions. 4/5 Kevin hedgewithcrypto.com

Videos for Margex+crypto

About – Margex

A New Investment Platform - Learn More

Margex is a digital asset trading platform that allows users to trade a variety of crypto assets with up to 100x leverage. Margex is set on a mission to provide a fair, secure, and easy-to-use platform with the highest class of financial technologies globally.

How Commodity Trading Works: The Complete Guide

How commodity trading works

Videos for How+commodity+trading+works

How commodity trading works. From production through to delivery, commodity traders look for opportunities to transform commodities in terms of how they are transported, stored, blended and processed.

Day Trading Screeners - Simpler Trading

Margex Review (2021) - Should You Use It?

How commodity trading works Commodities Demystified

Trade finance is how commodity traders get to always have enough funds or capital resources to ship commodities whenever an international buyer makes a request. This makes financial institutions key players in the commodity trading business, as without them, commodity traders cannot truly attain accelerated growth and success.

Trading firms aim to maximise the price differential between the price they pay for (untransformed) commodities and the revenue they earn by selling (transformed) commodities. Minimising the overall cost of acquiring commodities is therefore a priority. They work with producers to secure long-term, cost-effective supply. Reducing overall cost

Commodity traders try to make money by predicting the price (higher or lower) of a commodity during a specific timeframe. But buying futures is one of the popular ways to invest in the commodities market. You’re buying commodities and, based on previous years’ yields and this year’s outlook, you’re hoping to sell, at some later time, for a profit.