leverage trade crypto usa crypto exchange leverage

Pre

Top 5 Crypto Derivatives Exchange in 2020 1350 x 770

Cryptocurrency Exchange with Leverage - Margin Trading

Leverage trading: What, Why, How? Ledger

Buy Crypto In 3 Minutes - Buy Bitcoin & Crypto Instantly

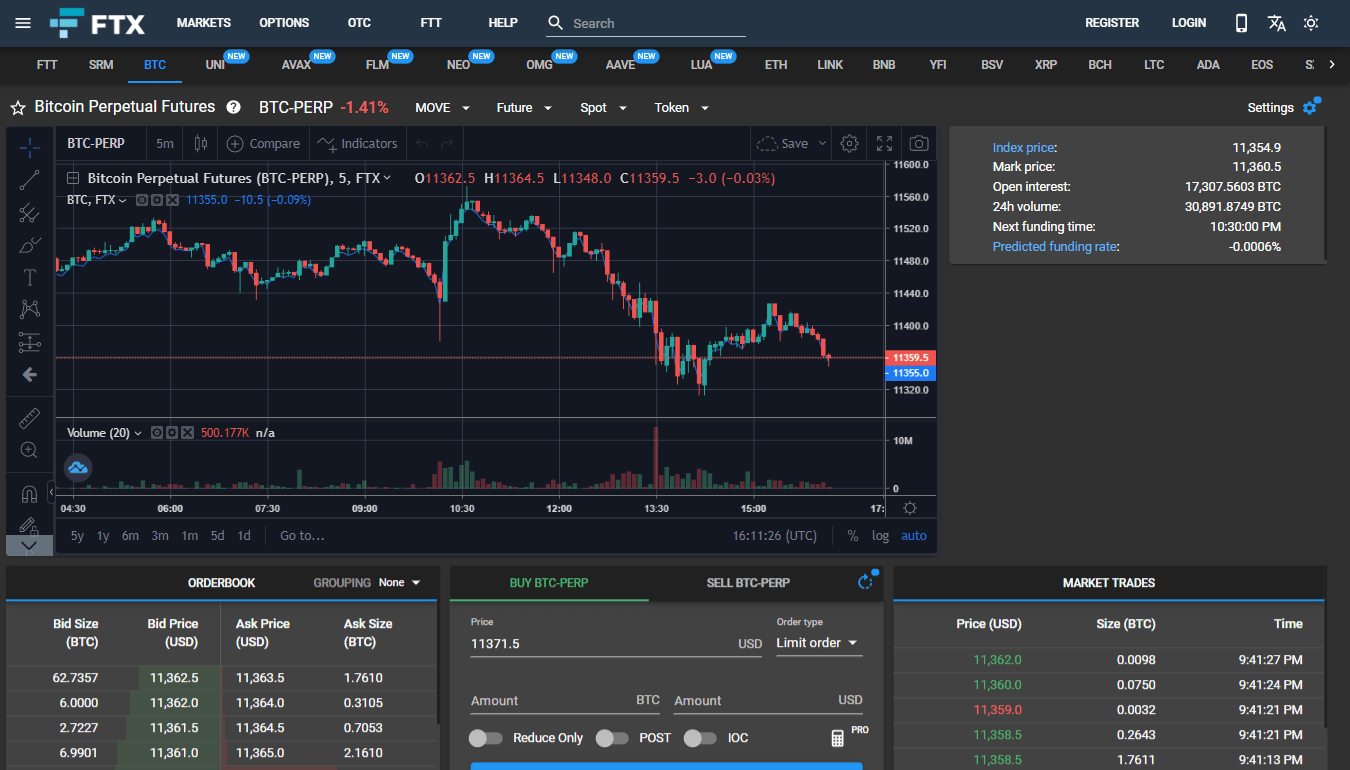

2021’s Best C rypto Leverage Trading Platforms. 1. Bybit. Bybit is one of the most user-friendly crypto exchanges that is leverage on crypto futures markets, including some prominent crypto tokens. 2. PrimeXBT. 3. FTX. 4. Binance. 5. BitMEX.

Leverage trading crypto in usa? Hey guys, as a avid daytrader of 3 years, I had my struggles living in usa using offshore brokers to trade equities. I want to take my experience from trading small caps stocks to crypto.

How to Leverage Trade Cryptocurrency • Benzinga Crypto

Leverage Exchange Software Margin Trading Exchange .

Another benefit of margin trading on Kraken is that we offer extremely competitive fees. Depending on the currency pair you’re trading in, we’ll charge up to only 0.02% to open a position and up to only 0.02% (per 4 hours) in rollover fees to keep it open.

Margin Trading Cryptocurrency Leverage Your Trades Up To 5x .

Trading crypto assets is becoming a norm as traders are able to leverage currencies that they own to obtain additional assets in a short timeframe. For example, when SHIB rose from around $0.000008.

The rise in popularity of crypto exchanges offering up to 100x leverage is a clear trend over the years. But what does leveraging in crypto trading mean? How does it work?

Cryptocurrency Exchange with Leverage. If you are looking to trade cryptocurrencies but have access to limited capital, it is well worth considering margin trading which has recently taken the cryptocurrency trading world by storm. Margin trading allows you to increase your buying power by borrowing money from a cryptocurrency exchange or brokerage and providing you with the potential for greater profits.

9 Best Crypto Platforms For Leverage Trading (2022 .

How Leverage Trading Works. The way leverage trading works is that a trader will make an initial deposit to borrow funds. For instance, if you wanted to invest $5,000 in a leveraged trade at a .

Videos for Crypto+exchange+leverage

Beginner Sep 28, 2021 · 6 min read. Key Takeaways: — In leverage trading, you are basically borrowing money from the exchange and making a bigger wager than what you traditionally could with your own money – i.e. you can make a $1000 wager with just $100. — Although having high upside potential, leveraged trading is one of the riskiest forms of trading crypto because it requires a lot of education before safely navigating it .

With unleveraged crypto trading, you would need to invest $10,000; that’s a considerable amount more. However, if your stocks go up, your profit margin is exactly the same. In other words, with leverage trading Bitcoin, much less capital is required up front to make the exact same profit.

What Is Leverage In Crypto Trading BITLEVEX

Due to strict financial regulations within most states in the United States, US retail investors and traders are currently forbidden from trading crypto Futures, perpetual, derivatives and CFD products. It is illegal to trade with leverage within most States in the USA. Exchanges based in the USA do not hold a licence for derivative crypto products.

Build a Crypto Portfolio - #1 in Security Gemini Crypto

Best Crypto Platforms For Leverage Trading. 1. FTX. FTX is a well-established and reputable cryptocurrency trading platform for leverage trading. The exchange has surged in popularity in recent . 2. Bybit. 3. Binance Futures. 4. Huobi.

Best Crypto Platforms For Leverage Trading (2022 .

Leverage trading promises huge returns, but in inopportune situations, it can also prove to be very disastrous. Hence, proper protocols should be implemented to protect traders and exchange owners against losses. Our leverage crypto exchange software is equipped with a versatile risk management integration.

Leverage & Margin Trading Cryptocurrency eToro

Crypto+exchange+leverage News

How does Leverage work in Crypto Trading? - Delta Exchange

11 Best Crypto Margin Trading Exchanges with Leverage 2022

Leverage in crypto trading – Winning trade example Let’s say you have $100 dollars deposited on a crypto exchange: You choose to use X5 leverage to buy Bitcoin at $36.000. Leverage gives you the power to buy $500 worth of BTC at that price. The market moves in your favor and Bitcoin’s price rises 15%.

Leverage trading crypto in usa? : BitcoinMarkets

How to Leverage More Crypto Using CFDs Benzinga