mirror protocol compare cryptocurrency exchange fees

Pre

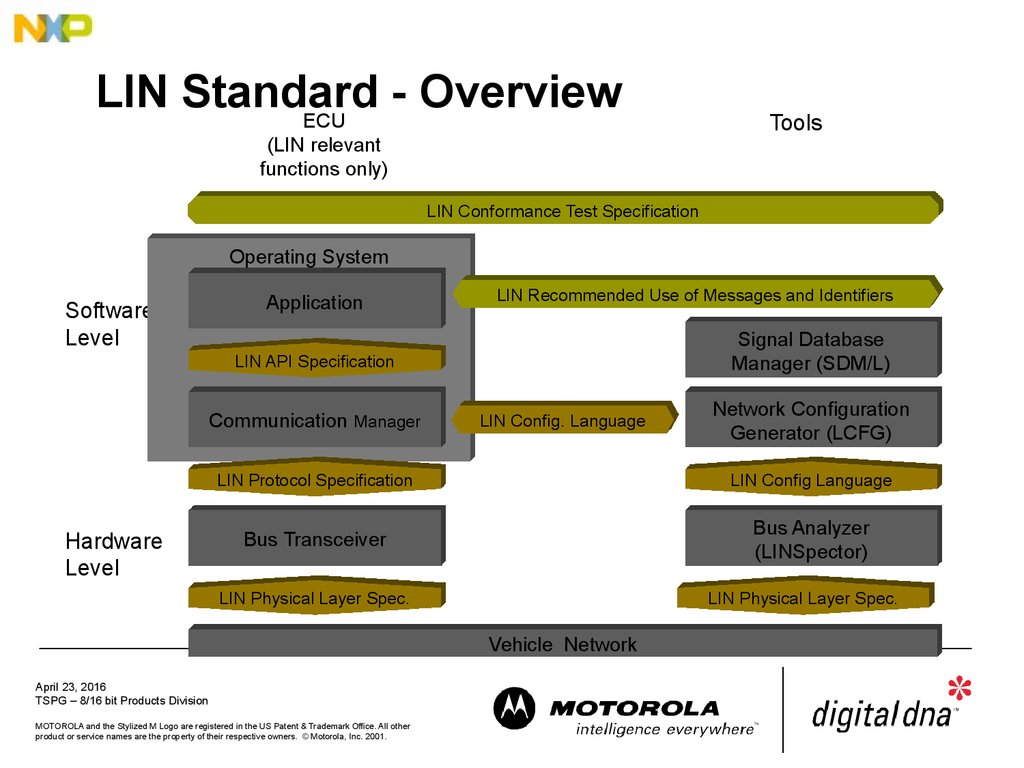

Lin protocol description. Automotive body network - online ... 1024 x 768

Compare crypto exchange fees: Find a better rate finder.com

Mirror

Compare Cryptocurrency Exchanges 2022 CryptoRunner

Mirror Protocol is a new entrant in the now expanding space of synthetic assets platforms. It works on the Terra blockchain and is available on Ethereum via the Shuttle-bridge. Also, these platforms allow every asset to be represented on the blockchain. So, Mirror Protocol allows synthesis and management of these tracked assets, what else does it do?

MIR is the governance token of Mirror Protocol, a synthetic assets protocol built by Terraform Labs (TFL) on the Terra blockchain. Mirror Protocol is decentralized from day 1, with the on-chain treasury and code changes governed by holders of the MIR token.

Buy, Sell & Store Bitcoin - Buy Bitcoin & Crypto Instantly

Mirror

What Is Mirror Protocol (MIR)? All About MIR Token

Mirror protocol is an interchain DeFi platform that also exists on Ethereum based Uniswap exchange. Assets on the protocol can be transferred to the Ethereum blockchain through a bridge called Shuttle. Thereby enabling Terra based assets like mAssets, MIR and UST tradable on Uniswap.

“Exchange” means that they offer normal trading with cryptocurrencies. “ Seller ” means that they do not offer trading with cryptocurrencies, instead they sell directly to customers. This usually means higher fees.

The Mirror Protocol is entirely built and governed by the community of MIR token holders, which is fairly distributed via liquidity and platform incentives without a team or investor pre-mine. MIR tokens can be used to propose and vote on important changes to the protocol here . Join the community In the news

On Mirror protocol, the mSQ-UST long farm currently shows a 20% APR. On Terraswap Dashboard, the mSQ-UST yield shows 5%. Is the 20% shown on Mirror protocol (#1) inclusive of the 5% (#2), i.e., the 20% aggregates the rewards paid in MIR (so it's actually around 15% paid in MIR tokens) AND the estimated transaction fees received by the pool (the .

Cryptocurrency Exchange Comparison Tool & Chart (2022)

Some exchanges offer tiered fee structures based on the amount of cryptocurrency each user trades per month — the higher your trading volume, the lower your fees. As an example, Bitfinex’s tiered fee structure ranges from 0.1% maker and 0.2% taker fees for users with a 30-day trading volume of less than $500,000 through to 0% maker and 0.1% taker fees for users with a 30-day trading volume of $30 million or more.

What's going on with Mirror Protocol? : mirror

Mirror Protocol is a DeFi protocol built on Terra’s blockchain for issuing and trading synthetic assets, called Mirrored Assets (mAssets). Mirror users are afforded the opportunity to participate in previously inaccessible markets, whether their former preclusion was dependent on government-dictated restrictions or a lack of capital to participate.

Best Cryptocurrency Exchanges 2022 – Compare Online

Mirror Protocol price today, MIR to USD live, marketcap and .

Mirror Protocol (MIR) Review: What You NEED To Know!!

Cheapest Cryptocurrency Exchange 2022 - Top 8 Low Fee Options

We collected multiple data points per exchange to assess popular benefits, like cybersecurity features, the types of cryptocurrencies available, cryptocurrency fees, and user reviews, among others. At Financer.com we make it easy for you to choose the best U.S. crypto exchange to invest in crypto.

The latest tweets from @mirror_protocol

What is Mirror Protocol Trade any stock from anywhere

2022 Crypto-Exchange Fee Comparison CoinTracker

Fees. Before choosing the best exchange, it’s vital to do a cryptocurrency exchange fees comparison first, as different companies tend to have different pricing models. Some request you to pay trading fees, others want percentage fees or simply have paid extra features. Either way, we have all of that covered in our crypto exchange comparison charts.

Types of crypto exchange fees. Cryptocurrency exchanges charge fees on different types of user behavior: Trading Fees — the primary source of revenue for exchanges. They are typically charged on both fiat-crypto trades as well as crypto-crypto trades. Deposit/Withdrawal Fees — some exchanges charge fees for deposits and/or withdrawals. Deposit fees vary based on the type of deposit but are less common than withdrawal fees since exchanges want to incentivize users to fund their account.

Mirror Protocol (@mirror_protocol) Twitter

Mirror

What Is The Mirror Protocol? An Introduction And How To Stake .

Compare+cryptocurrency+exchange+fees News

2021 Cryptocurrency Transaction Fee Comparison - CoinPayments .

Naturally, these fees can go up higher - specifically, they may reach 1,49%, if you're trading one cryptocurrency for another. Purchasing cryptos with fiat money, you will need to pay a fee of up to 3,99%. This, however, is pretty standard, since fiat-crypto purchases are always a bit more expensive.

Exchange fees are those charged to the users of crypto exchanges. Cryptocurrency exchanges charge fees from their users to make a profit, although they may also profit through other services or products like ads, cryptoanalysis tools, and more.

The Mirror Protocol promises the ability to trade equities (U.S. equities currently) 24/7 anywhere in the world by any person. The project does this by minting synthetic assets, or what they’ve named Mirror Assets (mAssets). It was created by and runs on the Terra Network, and is powered by smart contracts.

Videos for Mirror+protocol