cqg trading platform arbitrage cryptocurrency

Pre

Cryptocurrency arbitrage strategies — part I - Coinmonks ... 1499 x 1458

Crypto arbitrage tool - find best cryptocurrency arbitrage .

CQG Desktop offers trading, market data, charting, and analytics all in one easy-to-use product that can be customized to meet your trading needs. Easy-to-use and Powerful The new web-based technology doesn't require any software to download so it's easier than ever to access the markets with CQG.

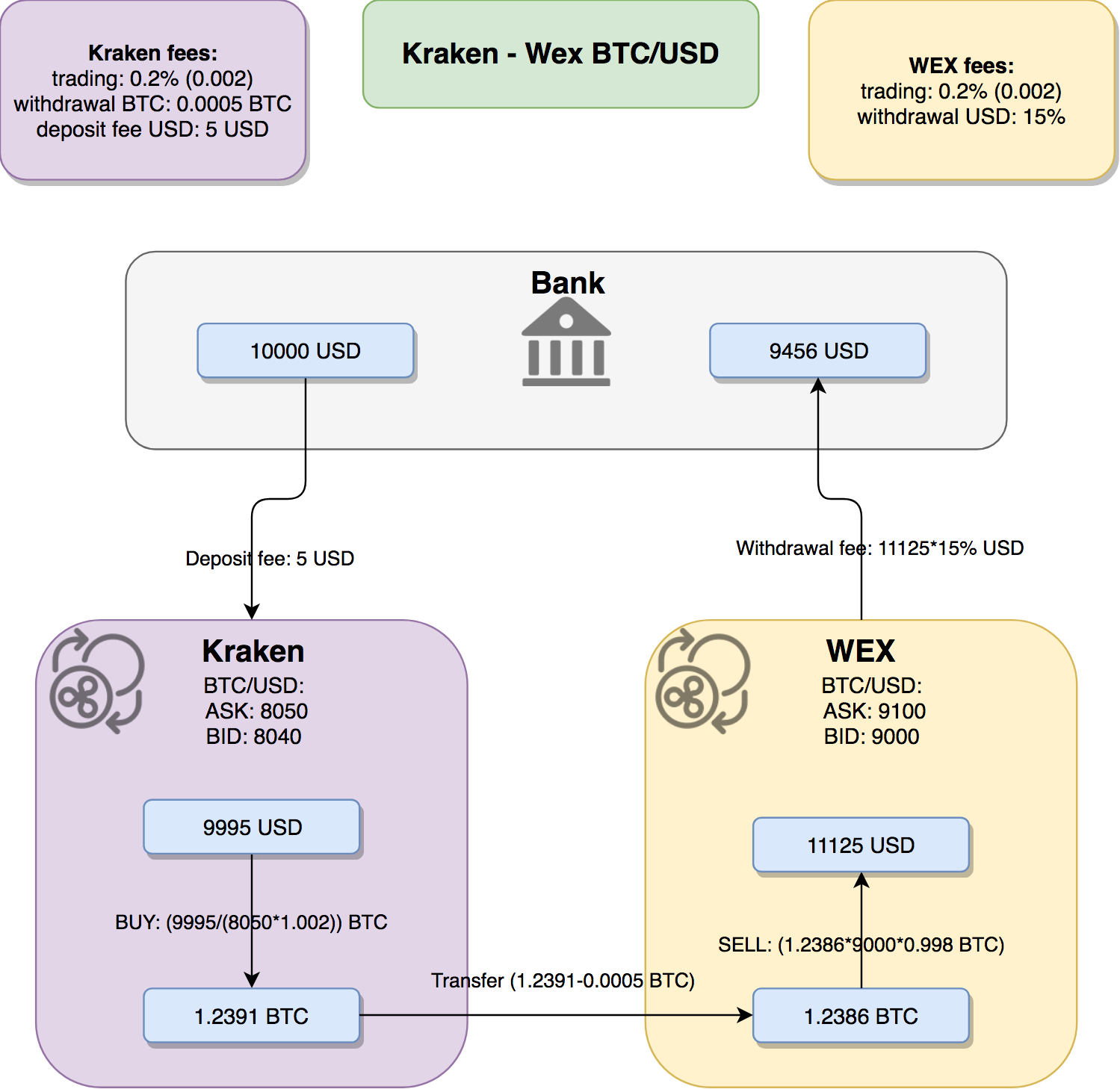

Cryptocurrency arbitrage is a strategy in which investors buy a cryptocurrency on one exchange and then quickly sell it on another exchange for a higher price. Cryptocurrencies like Bitcoin trade on hundreds of different exchanges, and sometimes, the price of a coin or token may differ on one exchange versus another.

Quotex - Trading Platform - Official Site

CQG Products - CQG Desktop

#1 in Security Gemini Crypto - The Safest Place to Buy Crypto

CQG Solutions - Trading

CQG Trader - Trading Platform AMP Futures

What is cryptocurrency arbitrage? Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. In a highly simplified example of how cryptocurrency arbitrage works, you would search for a specific coin that’s cheaper on Exchange A than on Exchange B.

Arbitrage is the concept of buying and selling cryptocurrency simultaneously but on different markets. This is because of the potential profit possible due to the price difference between the markets. This is not some revolutionary new concept, but a very old one which is used in all markets.

CQG Products - CQG QTrader

100% Free Forex Robot - Ready To Trade Forex For You

Here are some of the arbitrage types that would be common in the cryptocurrency space. Spatial/Geographical Spatial arbitrage is simply buying an asset in one market and then selling it in another where the price is higher. And in most definitions, this includes moving it in “digital space” from one online exchange to another. Cross-border

CQG creates technology solutions for financial markets. CQG is helping companies solve business challenges and improve customer experiences. We have been doing it for 40 years.

Crypto arbitrage takes advantage of the fact that cryptocurrencies can be priced differently on different exchanges. Arbitrageurs can trade between exchanges or perform triangular arbitrage on a single exchange. Risks associated with arbitrage trading include slippage, price movement and transfer fees. Every day, tens of billions of dollars worth of cryptocurrency changes hands in millions of trades.

CQG Desktop Trading Platform AMP Futures

Crypto Arbitrage: How It Works & Trading Strategies SoFi

Crypto Arbitrage executium Trading System

CQG Trader Download - Providing Futures Services - Since 1988

Videos for Arbitrage+cryptocurrency

Cryptocurrency Live Prices & Arbitrage - CoinArbitrageBot

CQG Technology Solutions for Financial Markets

Due to the market inefficiency and volatility, the arbitrage in cryptocurrency trading occurs more often compared to other financial markets What are some of the challenges of arbitrage trading? The primary challenges of the traditional arbitrage in cryptocurrency trading are the reaction, the need to quickly transfer funds from one exchange to another, and of course, withdrawal fees.

Coin arbitrage bot. queries even the most recent transactions. Free online bots can help synthesize fluctuations in value. In short it is an online magnificent robot tool that queries major crypto exchanges in real time and finds arbitrage opportunities according to your desired minimum percentage. You can also select a coin / token to get different prices on different exchanges and easily compare buying or selling opportunities.

CQG Desktop Trading Platform Key Features CQG Desktop is the next generation of trading and data visualization from the original data and analytics expert you've trusted for more than 35 years. CQG Desktop offers trading, market data, charting, and analytics all in one easy-to-use product that can be customized to meet your trading needs.

Guide to Cryptocurrency Arbitrage: How I made 1% profit an .

Award Winning Trading Platform - Interactive Brokers®

Cryptocurrency arbitrage made easy: A beginner's guide .

What is Crypto Arbitrage and How Does It Work? (2021) - Decrypt

Day Trading Tutorial - Simpler Trading LLC

We are connected to eighty-five market data sources and forty-five exchanges for electronic trading. Buy side or sell side, forex or futures, equities or energy, foreign or domestic, CQG connects you to the markets.

From the standard spreadsheet format to the look of big boards at the exchanges, CQG gives traders a number of ways to view the data streaming to CQG. It’s easy to move from one format to another and to incorporate many different components of the data: open, high, low, last, net change, percent change, volume, time of trade, and dozens of other values.

The professional trader's go-to platform, CQG QTrader includes analytics, charts, and multiple trade execution interfaces in one comprehensive solution. CQG QTrader offers many of the same features available in our flagship product, CQG Integrated Client.