leverage on coinbase pro crypto platform fees

Pre

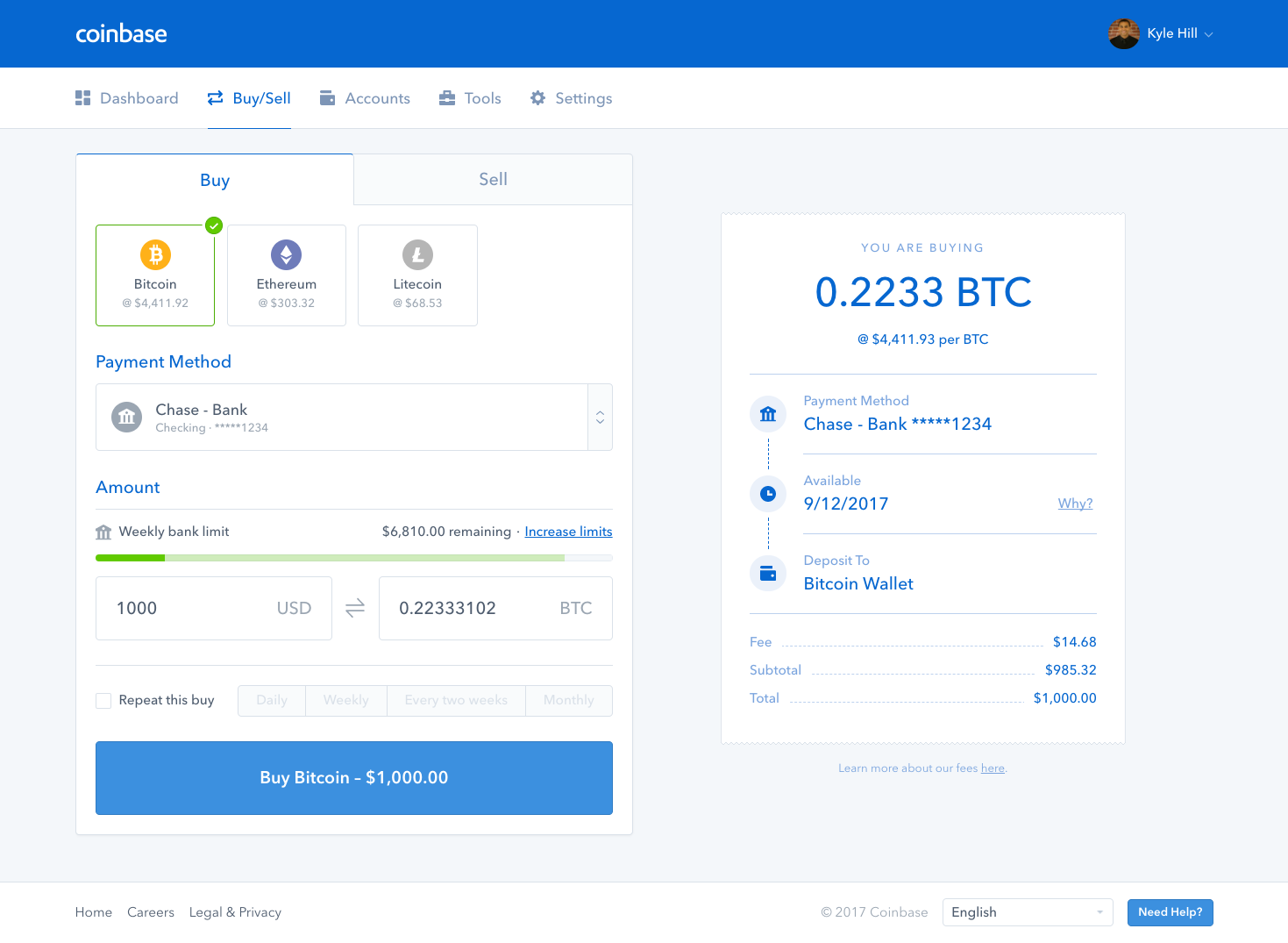

Can You Day Trade Crypto On Coinbase : Institutional ... 1469 x 1075

Margin trading is now available on Coinbase Pro by Coinbase .

10 Best Crypto Exchanges and Platforms of January 2022 .

6 Key Crypto Fees Explained & How They Cost You Money

Coinbase Pro Introduces MASK and RLY Networks

5 Crypto Exchanges With The Lowest Fees Cryptolad

Join our Crypto Telegram channel. Coinbase has officially launched its Margin Trading service on the exchange's professional trading platform, Coinbase Pro. Eligible traders can now trade up to 3X leveraged orders on USD-quoted books, which allows users to amplify their trading results through borrowing money. Coinbase's COO Emilie Choi told The Block in May that margin trading was on the way, but didn't reveal the exact leverage the service would feature.

Coinbase Kills it with More Leverage, Now Allows Instant .

Margin trading used to be available on Coinbase Pro, with a maximum leverage ratio of 2x (for LTC/USD pair up to $500, and for BTC/EUR pair up to 3,000 EUR), or 3x (on ETH/USD and BTC/USD pairs, up to a limit of $10,000). However, due to changes in the regulatory environment, Coinbase Pro is no longer offering this product to retail investors.

2022 Crypto-Exchange Fee Comparison CoinTracker

Videos for Crypto+platform+fees

Coinbase Pro Reintroduces Margin Trading With Up to 3x Leverage

Does Coinbase Have Margin/Leverage Trading? — CryptoChronicle.io

Charges 0.75% for trading crypto. The fiat to crypto conversion fee is 5%. eToro charges 0.1% for crypto-to-crypto exchanging or conversion . It includes a wide range of digital assets to trade including cryptocurrencies, CFDs, forex, stocks, exchange-traded securities, etc. Zero-dollar commission for US stock traders.

Coinbase Pro has reintroduced margin trading; Leverage is capped at 3x; Currently, the feature is only available to users from certain US states; Coinbase Pro is back in the crypto leverage trading game. The Coinbase Pro cryptocurrency exchange has re-introduced margin trading for users, although the service will initially only be available to users that reside in 23 US states. There are also additional requirements, however, as the exchange says the traders that will be selected as eligible .

How to Buy ETH 2x Flexible Leverage Index Coinbase

Crypto exchange fee summary Trading fees vary by more than an order of magnitude, from 0.1% to more than 1% on Coinbase and Gemini Bibox, Binance, Coinspot, HitBTC, and Kucoin offered the lowest taker fee of the surveyed exchanges at 0.1%. Binance and Bibox offer even lower rates when paying with their exchange tokens

TL;DR- Coinbase Pro shut down its margin trading on November 25th, 2021 due to regulatory pressure from the US government. Don’t fret- you could set up an account on KuCoin and get it funded and then use leverage on KuCoin. You’d then have to send your funds back to Coinbase for withdraw when that time comes.

Coinbase Pro Relaunches Margin Trading After Two-Year Pause

They claim that “at least 90%” of the assets on the exchange are stored offline in “geographically-redundant, secure locations.”. The fees on their AUD and GBP trading pairs stand at 0.20% and 0.15%, while the fees that apply to crypto/crypto are 0% and 0.05%, taker and maker respectively. Visit Site. 3 / 5.

Most Secure, Trusted Platform - Buy Bitcoin & Crypto Instantly

Best Crypto Exchanges With Low Fees - 2022 Reviews & Comparison

Coinbase Pro Review – Why This Is THE Place To Trade Crypto

Coinbase has introduced new functionalities that now allows its customers to buy or sell cryptocurrencies instantly unlike previously when they have to wait for days. Also, the daily limit has been increased 7 times i.e. $25,000 per day which will be rolled out for US customers soon.

Their fees might not be that good when compared with the exchanges above, but compared to the rest of the market, their fees are still very reasonable. Fees. The transaction fees vary between 1.49%- 3.99%. These rates vary due to certain factors.

13 Crypto Exchanges with the Lowest Fees. 1. Binance. Binance tops our list of crypto exchanges with lowest fees. It has a 24-hour trading volume of $917 million, which makes it the largest . 2. HitBTC. 3. Bitfinex. 4. KuCoin. 5. Kraken.

Feb 12, 2020 · 3 min read. Starting today, Coinbase Pro customers in 23 U.S. states can access up to 3x leverage on USD-quoted books. Today we’re excited to announce the availability of margin trading for eligible Coinbase Pro customers.

13 Crypto Exchanges with the Lowest Fees - Blocklr

Top 10 Best Crypto Exchanges With Low Fees [2022 Ranking]

If you’re using Coinbase Wallet on your mobile phone, you can purchase ETH 2x Flexible Leverage Index right in the app. Tap on . Then tap on the “Trade” tab, where you can swap ETH for any token that runs on the Ethereum standard (called “ERC-20 tokens”). Tap “choose coin” and select ETH 2x Flexible Leverage Index.

From the launch date of July 15, 2021, Coinbase Pro will be admitting the modish networks into the exchange. The trading ventures will commence on July 15 at 8 AM Pacific Standard Time (PT). The crypto networks of MASK and RLY are a leverage point for client’s trading pursuits.

Fees include an estimated 0.5% trading fee (this may vary depending on market conditions) and a tiered transaction fee depending on the amount of crypto purchased, ranging from 2.3% for amounts .

1. Maker Fees A lot of big crypto platforms, especially exchanges, operate using a maker-taker fee system. Maker fees are a common exchange fee and, as the name suggests, are charged to makers on a platform. A maker generally makes an order within an order book that can be fulfilled by someone else later on, not immediately.