crypto tax report israel forex white label

Crypto to US Dollar Gains Taxes and Form 8949 – The ... 1616 x 1124

Videos for Crypto+tax+report

Crypto.com Tax The Best Free Crypto Tax & Bitcoin Tax .

Taxes: How to report crypto transactions to the IRS. Duration: 05:23 8 mins ago. EY Tax Partner and Principal Thomas Shea joins Yahoo Finance Live to explain what crypto investors should know .

Contact Us - Admirals

Hosting Resellers Can Make 100% - 150% Profit from Websnoogie .

Taxes: How to report crypto transactions to the IRS

White Label partnership Help center Risk warning: Trading Forex (foreign exchange) or CFDs (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors.

The Israel-based investment platform’s expected revenue is 30% higher than the $222 million generated in the Q3 2021 and nearly 77% compared to the fourth quarter of 2020. The numbers are still lower than the revenue eToro registered in the first two quarters of the year.

Demands Soar for HashCash's New Age Forex Trading with .

White-Label Streaming Video Partners

EY Tax Partner and Principal Thomas Shea joins Yahoo Finance Live to explain what crypto investors should know before filing their 2021 taxes. BRAD SMITH: Whether you're the dogefather, the self .

White Label resellers report at least 100% - 150% return on investment on Websnoogie's white label website design and hosting services. This gain is the undoubted low price of the company's .

White-Label Streaming Video Partners Launch your own white-label video streaming platform and become streaming video service provider yourself. The video streaming market is booming like never before (expected to touch $12 Billion by 2014) with consumer adoption of broadband creating unique opportunities for uploading and monetizing rich media .

Santhosh T - Engineer (Hardware and Technology ) - Apple .

Crypto.com Tax offers the best free crypto tax calculator for Bitcoin tax reporting and other crypto tax solutions. Straightforward UI which you get your crypto taxes done in seconds at no cost. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Calculate and report your crypto tax for free now.

Easy Guide to Crypto Taxes for 2022 Gordon Law Group

Launched a unique mobile content white label with advertisement in Spain, Norway, Sweden, Finland, Denmark, Israel and Arab countries. Trained staff in media buying, customer acquisition, and optimization. Responsible for media budget and technical analysis of statistics for ROI purposes.

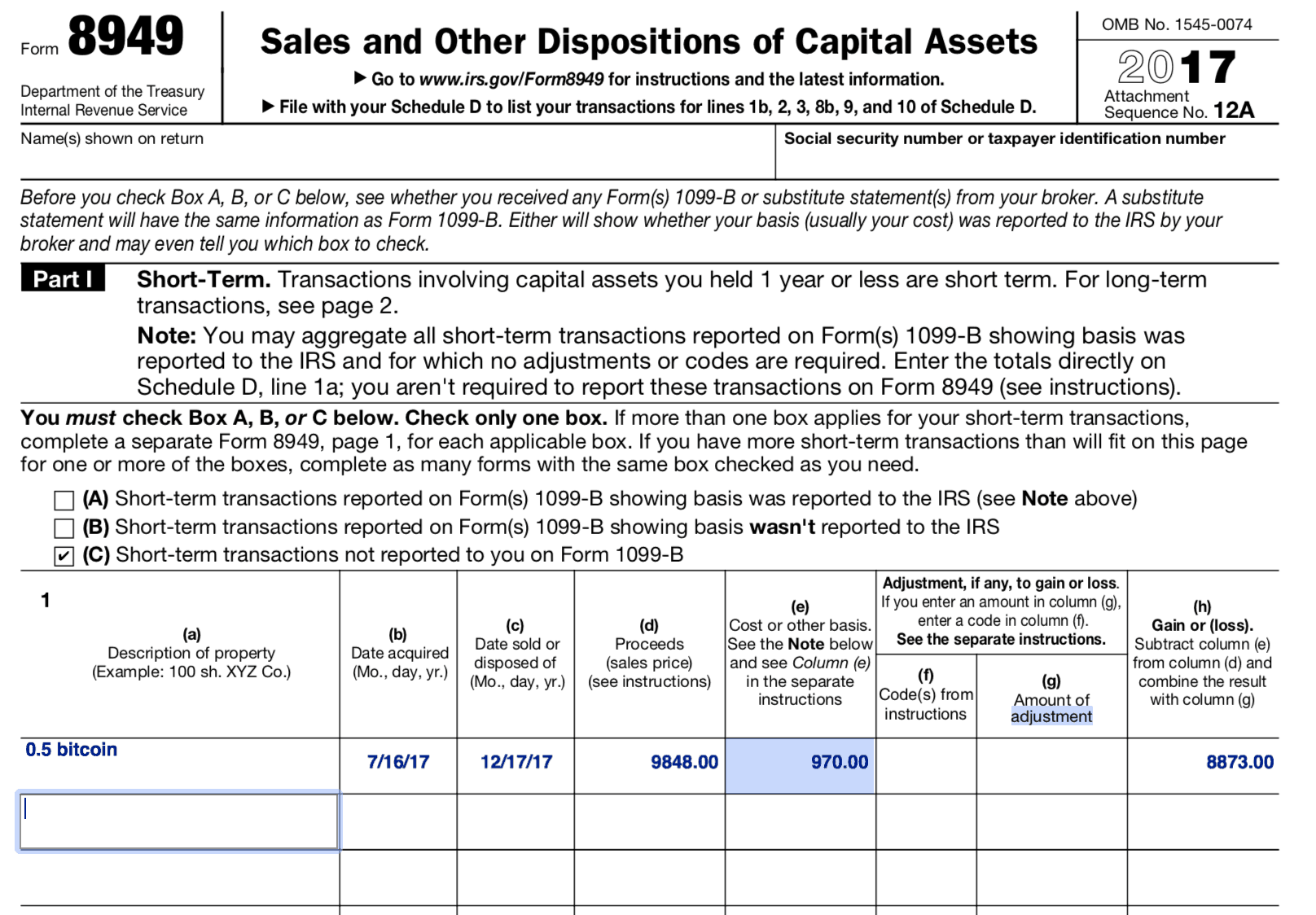

You need to report your crypto capital gains and losses on Schedule D and Form 8949, and you need to report your crypto income on Schedule 1 or Schedule C. US taxpayers need to attach all these forms to your Individual Income Tax Return Form 1040 by April 15th 2022. To report your crypto tax to the IRS, follow 5 steps: Calculate your crypto tax. You need to know your capital gains, losses, income and expenses.

Taxes: How to report crypto transactions to the IRS

Industry Executives Finance Magnates Directory

Information about the managerial staff in the Forex industry, including articles and personal information. . White Label Solutions . Israel Italy .

Israel+forex+white+label - Image Results

Israel Public Relations Advice. NEW YORK, Jan. 6, 2022 /PRNewswire/ -- Public Relations executive Ronn Torossian released the following book excerpt from his best-selling PR book, "For Immediate .

How to report cryptocurrency on taxes. Filing your cryptocurrency gains and losses works the same way as filing gains and losses from investing in stocks or other forms of property. There are 5 steps you should follow to file your cryptocurrency taxes: Calculate your crypto gains and losses. Complete IRS Form 8949.

You must also attach a full crypto tax report to your return showing all of your trades. The IRS has clarified that if all you did was purchase cryptocurrency with USD, you do not need to check “yes.” Otherwise, almost any involvement with crypto requires a “yes.” How Is Cryptocurrency Taxed? The Basics

IRS Crypto Tax Forms 1040 & 8949 Koinly

eToro expects fourth quarter commission revenue to reach $290 .

Crypto+tax+report News

BetterCare. Aug 2021 - Present5 months. Israel. Vice President of Business Development at BetterCare. Digital communication management platform for caregivers. Removes the language barriers faced in many institutions with user friendly interface allowing caregivers to follow schedules easily and update in real time.

Nissim Cohen - Israel Professional Profile LinkedIn

A crypto-forex exchange platform helps in increasing the scope for business opportunities promoting growth. This will further boost the quest for innovation. White label solutions from HashCash.

How to Report Cryptocurrency On Your Taxes . - CryptoTrader.Tax

Israel. Sravan Vemuru . Fx Broker, Forex White Label Solutions, CFD, IB & MIB Provider Managing Director, CEO, Founder India. Santhosh T Team Manager - Order .

Israel Public Relations Advice

Lior Shmuely - Vice President Of Business Development .

Build a Crypto Portfolio - #1 in Security Gemini Crypto