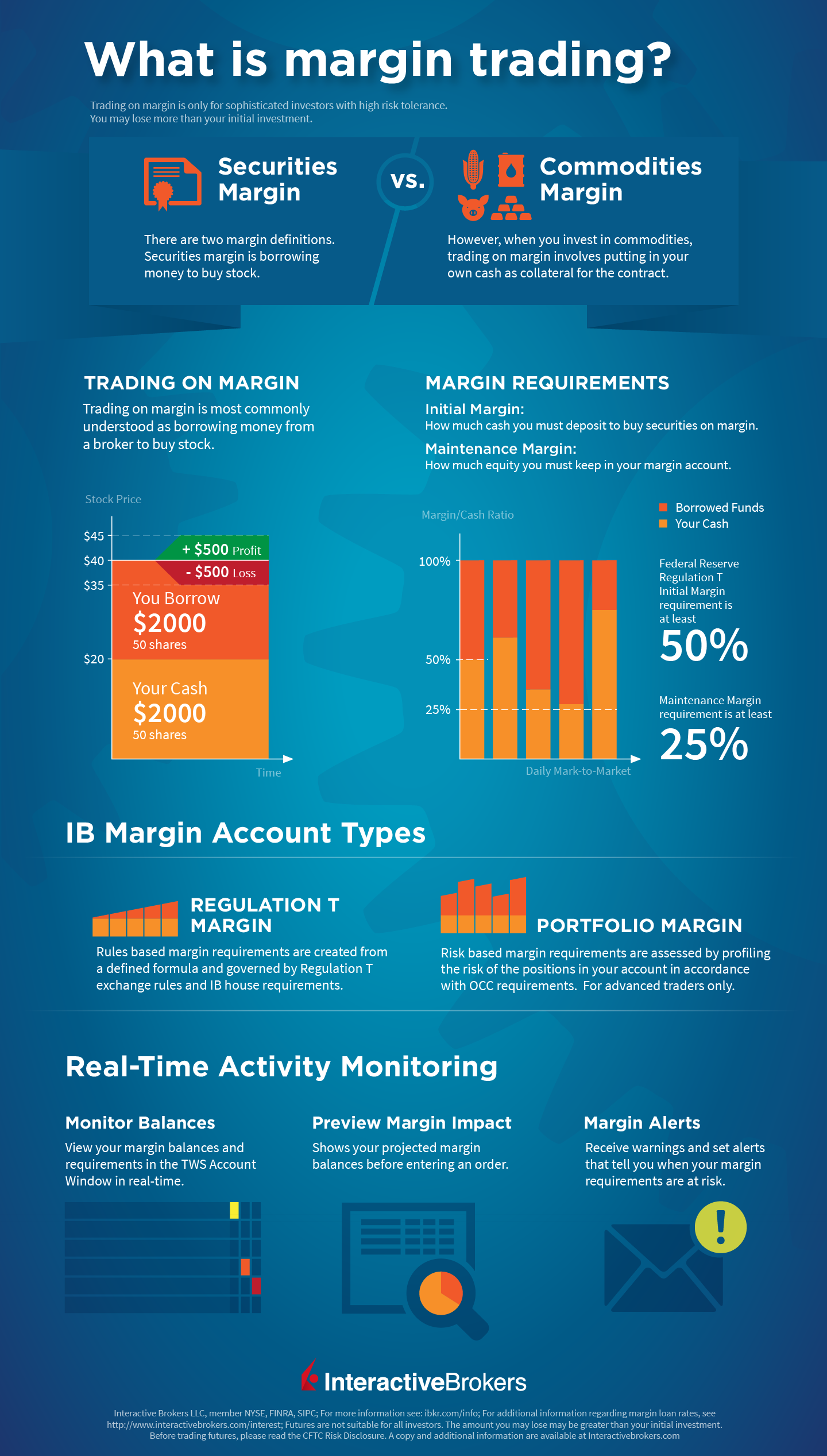

low margin futures trading brokers trading margin meaning

Margin Trading | Interactive Brokers Australia Pty. Ltd.

1440 x 2535

Futures Brokers With Lowest Day Trading Margins Binary ...

3840 x 963

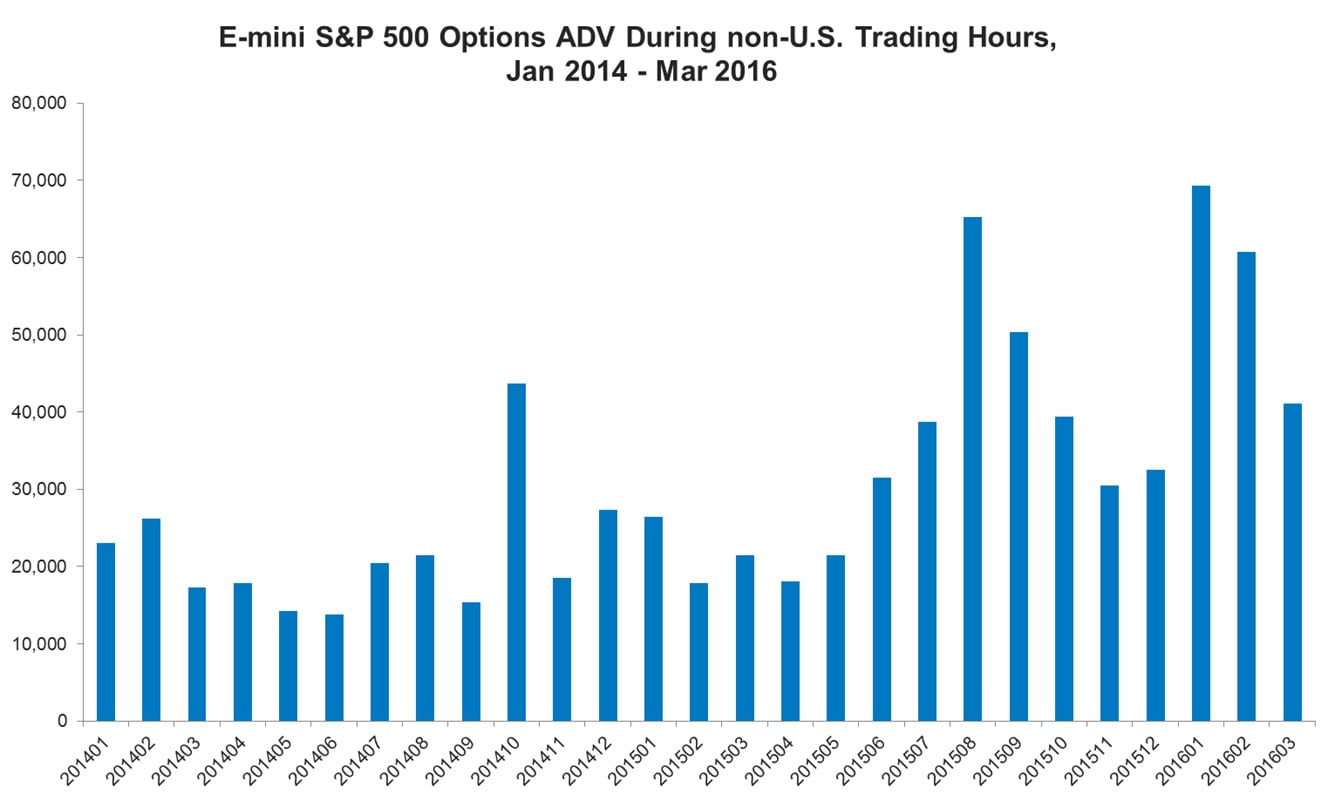

Futures options interactive brokers ~ suvagadapaw.web.fc2.com

1335 x 801

MotiveWave - Zytrade Futures

3574 x 2108

Blog_2021_07_21 - Low Cost Stock & Options Trading ...

1366 x 768

Blog_2021_06_09 - Low Cost Stock & Options Trading ...

1366 x 768

How Are Futures Trading Profits Taxed Best Non Correlated ...

1919 x 1039

NOW TRADE WITH LOW MARGIN IN COMEX, FOREX, METLDEX ...

1024 x 1024

Futures Tips Trading Hours Dax Futures

1522 x 1270

Trade Options on Futures with NinjaTrader Brokerage ...

4560 x 1175

Hpliga | Lowest Brokerage | Online Option Trading ...

1366 x 768

Ishares Us Broker Dealers Etf Infinity Futures Day Trading ...

1961 x 1749

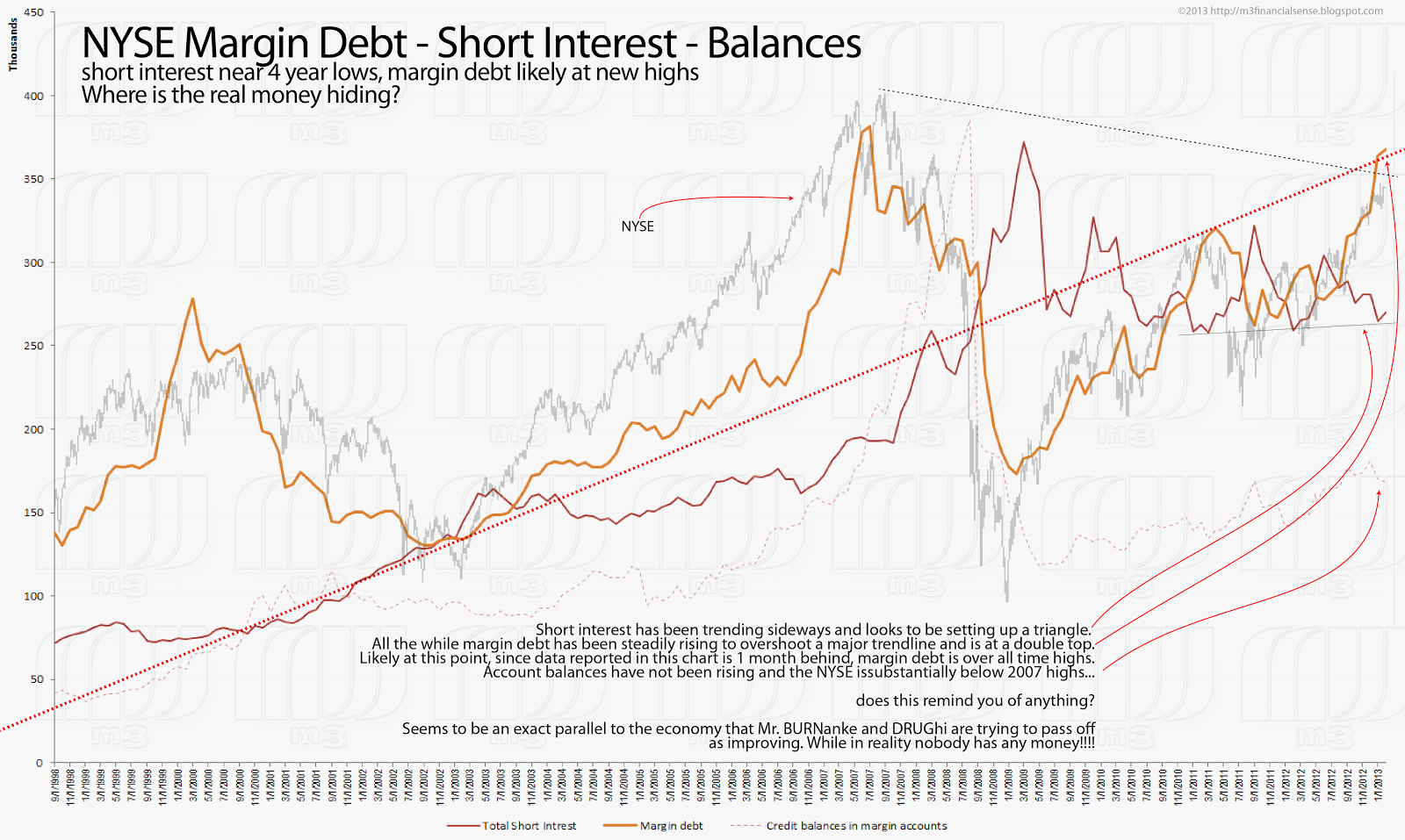

Futures Trading Margin Account Corporations With Low Debt ...

1585 x 1484

2021_04_26_Here_The_Latest_Batch_Of_Buy_The_Dip_Winners ...

1366 x 768

Interactive Brokers Review 2017 - StockBrokers.com

1200 x 892

Blog_2021_03_17 - Low Cost Stock & Options Trading ...

1366 x 768

Top 10 High Margin Stock Broker In India For Trading

2229 x 1127

HOW NOT TO GET A MARGIN CALL? for FX:EURUSD by Marenno ...

1596 x 843

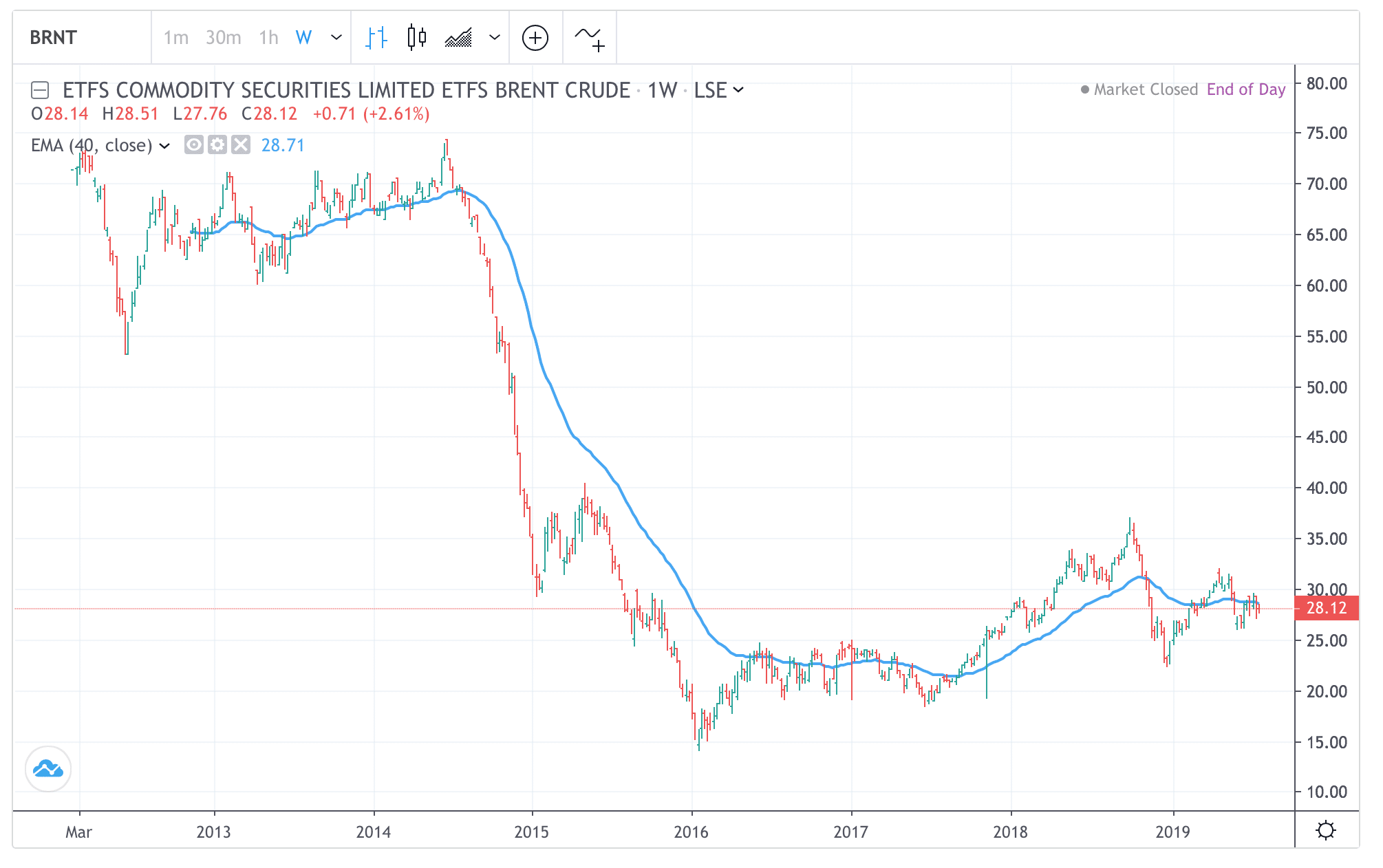

Top 10 Brokers to Trade Brent Oil - Compare Brokers

2010 x 1262

Sample Commodity Charts from HPCT - Natural Gas Futures ...

1937 x 1002

Forex Trading Brokers In Canada - Tips On Forex

1600 x 918

Stock futures dip even after Amazon reports profit surge ...

1999 x 1333

Fed Funds Futures aren't pricing in a December interest ...

1773 x 968

Trading Gold Mini Futures Demo Trading Account For Stocks

1439 x 825

Uk And Us Trading Forex Amp Futures Minimum To Trade ...

1898 x 965

Etrade margin rates per year, trading futures options ...

1600 x 957

Undervalued Small Cap Stocks November 2020 Td Ameritrade ...

1400 x 855

Excessive Use of Margin - Heiner Law Offices

1950 x 921

Futures Trading | Discount Commodity Brokerage Services ...

1920 x 1104

Stock futures are flat as S&P 500 hovers near a record ...

3451 x 2300

DPL ONLINE - Lowest Brokerage in India | Online Stock Trading

1920 x 1080

Lowest margin for option writing (Selling) | The Next Trade

1920 x 1369

BullsBits | Welcome to BullsBits

2048 x 1365

Lowest Brokerage Charges In Option Trading – UnBrick.ID

1080 x 1080

Lowest Brokerage Charges In Option Trading – UnBrick.ID

1080 x 1080

Margin Trading | Interactive Brokers U.K. Limited

1440 x 2535

Margin Trading - TradeStation

1627 x 914

Bitcoin Margin Trading: How It Works, And Common ...

1472 x 981

10 Best Crypto Trading Bots to Use in 2020 - Crypto Pro

1200 x 831

What is the Isolated Margin Mode? How to Add Auto-Margin ...

2400 x 819

Mechanical Options Trading: 2019

1424 x 1004

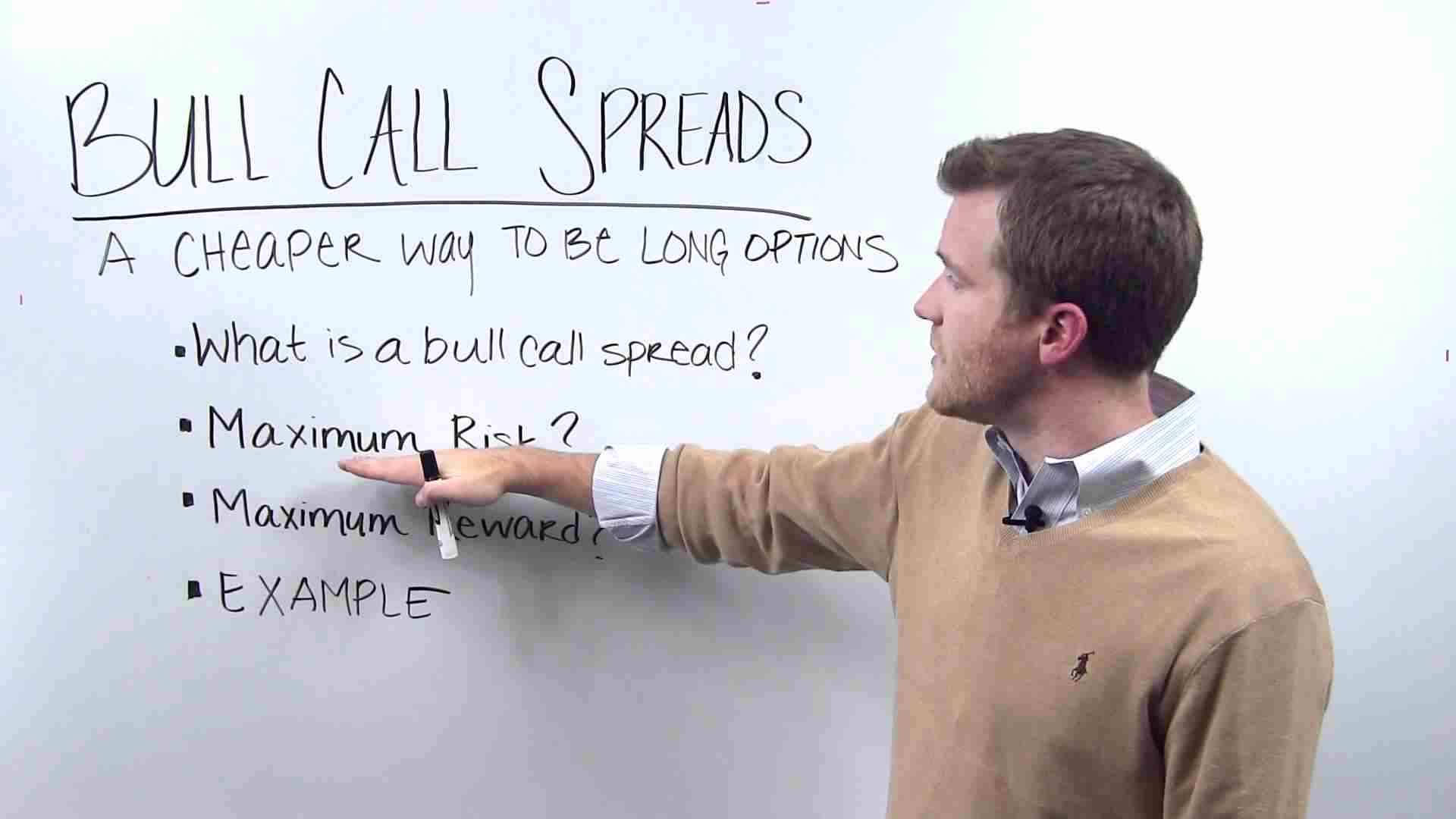

Bull Call Spread | Strategy, Meaning, Diagram, Example, Margin

1920 x 1080

Intraday Trading Vs Day Trading How To Make A Day Trading ...

3840 x 5256

Infratil (ASX:IFT) downgrades earnings - Sequoia Direct ...

1920 x 1080

Trade with Interactive Brokers - Margin Rates as Low as 0.75%10 Best Futures Brokers for Commodity Trading in 2022 • BenzingaMargin in trading is the deposit required to open and maintain a leveraged position using products such as CFDs and spread bets. When trading on margin, you will get full market exposure by putting up just a fraction of a trade’s full value. The amount of margin required will usually be given as a percentage. What is Margin in Trading? Meaning and Example IG UKCharles Schwab – The Best Broker for Margin Trading Futures. Also adhering to the U.S. Federal Reserve Board’s Regulation T, standard margin accounts at Charles Schwab requires a minimum deposit of $2,000 and allow for 2:1 leverage (50% margin). The Basics of Trading on MarginCost is $0.85 for futures and futures options trading, overall, Interactive Brokers offers the lowest margin rates in the industry, between 1.91% to 1.41% (the lowest percentage is for clients . Margin Trading Definition: Online Trading with margin is the actual trading with borrowed capital. This borrowed capital is lent by the broker and it is available to the trader, who must deposit a margin. The trader can, therefore, trade more capital on the financial markets than he actually owns. Higher profits and losses are thus possible. What is Margin Trading? - FidelityWhat is Margin Trading? Definition of Margin Trading, Margin .Forex Broker - Global Prime - ReviewSo basically we’re down to M1 Finance, Interactive Brokers, and Robinhood for the lowest margin rates. All offer commission-free investing. Let’s compare some of the nuances. First, let’s talk about Interactive Brokers. The minimum invested balance to access margin at Interactive Brokers is $100,000. The minimum for M1 Finance is only $5,000. Margin trading refers to the practice of using borrowed funds from a broker to trade a financial asset, which forms the collateral for the loan from the broker. A margin account is a standard brokerage account in which an investor is allowed to use the current cash or securities in their account as collateral for a loan. 5 Best Futures Trading Platforms in 2022 StockBrokers.comYes, a margin account is required to trade futures with an online broker. The margin requirements will vary depending on the instrument being traded. For example, the S&P 500 e-minis are the most popular futures contracts traded (alongside the most liquid) in the United States, so margin requirements are lower, on average. Margin DefinitionIn margin trading, your trading account is extended credit to increase its trading value. When you trade on margin, each dollar in your account is worth more in a trade than it is at face value. This method creates the possibility for huge gains but also significant losses. Margin trading is best for experienced traders who have a clearly defined risk management policy. Lowest Margin Rates Brokers (2022 Comparison)What is Margin Trading? +++ Definition & example (2022)What Is Margin Trading? Meaning, Benefits, Example Smart .Trade Futures 4 Less offers low day trade margins to accommodate traders that require high leverage to trade their accounts. The lower the margin, especially Day Trading Margins, the higher the leverage and riskier the trade. Leverage can work for you as well as against you, it magnifies gains as well as losses. $990 – US Equity Index. $500 – FX. What Is Margin Trading and How Does It Work .Futures Options Trading - TradeStation FuturesPlusInteractive Brokers® - Margin Rates as Low as 0.75%Quotex - Trading Broker - Digital Asset TradingDefinition: In the stock market, margin trading refers to the process whereby individual investors buy more stocks than they can afford to. Margin trading also refers to intraday trading in India and various stock brokers provide this service. Margin trading involves buying and selling of securities in one single session. Best Margin Trading Platform January 2022 - Cheapest Brokers .Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Please assess your financial circumstances and risk tolerance before trading on margin. Margin credit is extended by National Financial Services, Member NYSE, SIPC. Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of an investment and the loan amount. Margin trading refers to the practice of. Initial Margin is the amount required to hold each position past the market close. This margin amount can go as low as the Maintenance Margin before the client is required to replenish funds back to Initial Margin Requirements if the positions are held past the market close. Day Trade Margin is set by Discount Trading. This is the minimum amount required to hold a position per contract on an intra-day basis. Trade Alert APIs from Cboe - Trade Alert APIs - cboe.comMargins - Trade Futures 4 Less Prime Futures BrokerageMargin trading is when you buy and sell stocks or other types of investments with borrowed money. That means you are going into debt to invest. Margin trading is built on this thing called leverage, which is the idea that you can use borrowed money to buy more stocks and potentially make more money on your investment. But leverage is a double-edged sword that also amplifies your risk. Lowest Futures Margins Futures Day Trading Margin .