how commodity trading works td ameritrade crypto etf

Forex indices futures strategies for change - grasperluper ...

2336 x 1232

/GettyImages-521028114-577008c55f9b58587583ea3e.jpg)

Carbon Emissions Trading: Definition, How It Works

2000 x 1333

Trading Secrets (Stock, Futures, Options, Commodity or ...

2481 x 3508

ProfitTrain No-Repaint Indicator Meta Trader 4 MT4 FOREX ...

1480 x 1051

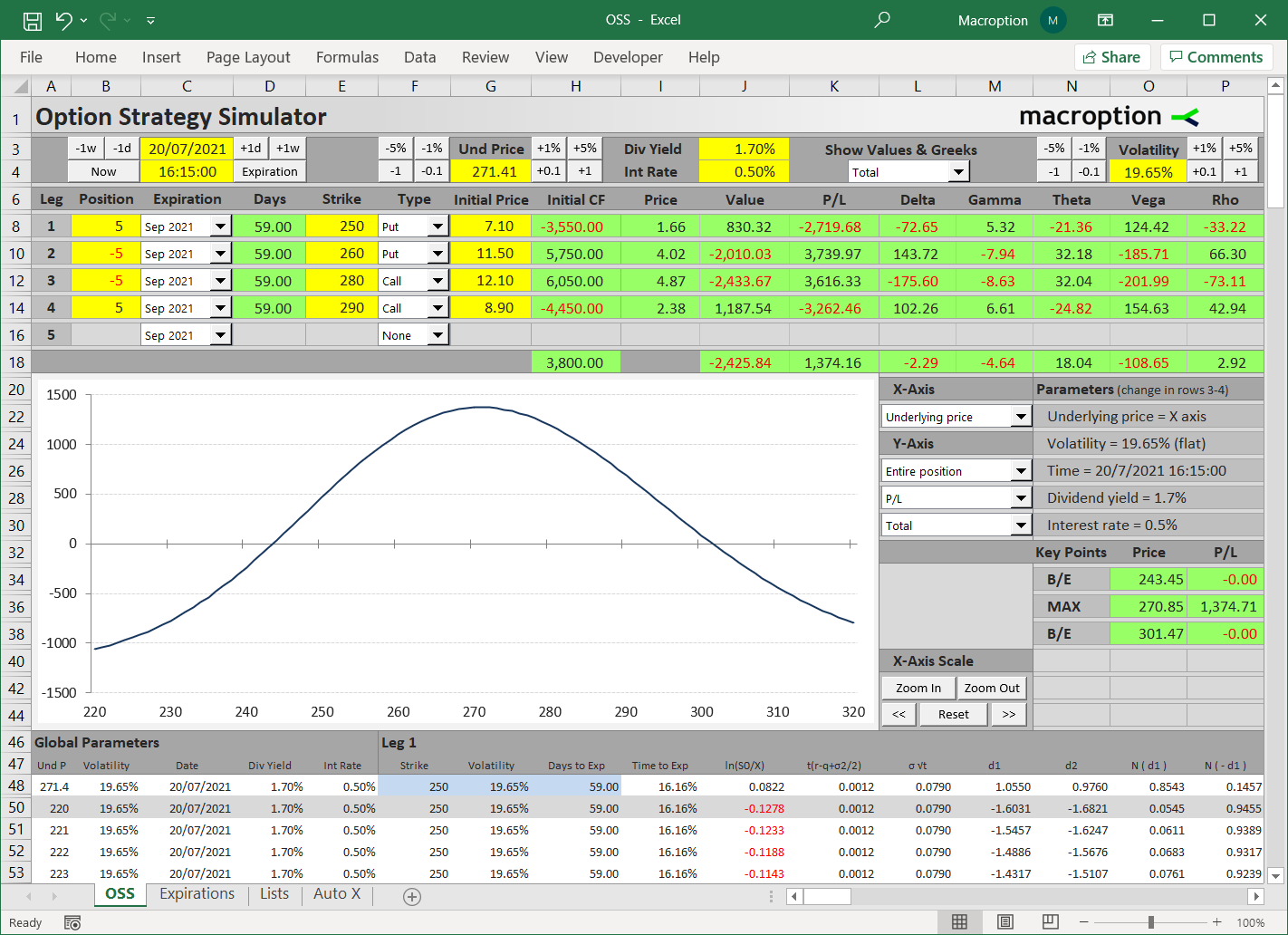

Option Strategy Simulator - Macroption

1422 x 1032

New York, Chicago Traders Forced to Quit Pits Move Next ...

2200 x 1467

Sultan Saed Al Zahrani Est

1920 x 1080

10 Technical Trading Indicators You Must Know

1560 x 826

Calcium Ammonium Nitrate 27% N – DRTC Trading Company

2136 x 3216

Brokerage Firm TD Ameritrade Invests in Crypto Exchange ErisX

1300 x 866

Charles Schwab in advanced talks to buy TD Ameritrade ...

1200 x 801

Market Vectors Morningstar Wide Moat ETF (ETF:MOAT ...

1024 x 768

Dogecoin Stock Ameritrade / Cryptocurrency Trading Td ...

1280 x 1280

Marijuana Stocks, ETFs, Data And Top News From Cannabis ...

1024 x 768

Hitachi to Utilize Blockchain by Settling Payments Through ...

2000 x 1333

Why Isn't Dogecoin On Td Ameritrade - DINCOG

3300 x 2550

Ttm Squeeze Scanner - Prorealtime Codes Library ...

3375 x 1187

SPDR S&P 500 ETF (ETF:SPY) - How Do You Trade Options ...

1024 x 768

About this ETF. The investment seeks to provide investors with capital appreciation.Under normal market conditions, the fund will invest at least 80% of its net assets (plus any investment borrowings) in the common stocks and American Depositary Receipts (“ADRs”) of Crypto Industry Companies and Digital Economy Companies. To put that in perspective, td ameritrade charges $6. 95 per etf trade! Another way to get indirect exposure to bitcoin and the crypto industry is through other cryptocurrency and blockchain industry-focused etfs, like siren nasdaq. 6 дней назад — pros: trade stocks, etfs, and crypto on one platform. Ironbeam Futures Contracts - Brokerage AccountCommodity trading involves different types of contracts that derive their value from the underlying commodity. In India, commodity contracts include spot, futures, and options contracts. In spot. Certain ETFs purchased will not be immediately marginable at TD Ameritrade through the first 30 days from settlement. For the purposes of calculation the day of settlement is considered Day 1. Morningstar, Inc. is not affiliated with TD Ameritrade and its affiliates. TD Ameritrade: Tom Lydon Talks the Bitcoin ETF LaunchCommission-Free ETFs on TD Ameritrade. This page contains a list of all U.S.-listed ETFs and ETNs that are available for commission free trading within TD Ameritrade trading accounts. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts (note that various restrictions may apply). How Commodity Trading Works - Cannon TradingTrading firms aim to maximise the price differential between the price they pay for (untransformed) commodities and the revenue they earn by selling (transformed) commodities. Minimising the overall cost of acquiring commodities is therefore a priority. They work with producers to secure long-term, cost-effective supply. Reducing overall cost Day Trading Screeners - Simpler TradingHow commodity trading works Commodities DemystifiedHow Commodity Trading Works Step-by-Step Detailed TutorialLeveraged ETPs are set to a margin requirement equal to 2X or 3X the TD Ameritrade base maintenance requirement of 30% (not to exceed 100%): 2X = 60% and 3X = 90%. The TD Ameritrade base maintenance requirement for naked options is multiplied to correspond with the equity margin requirement. Can you buy Crypto with TD Ameritrade in USA? (2021)Trade finance is how commodity traders get to always have enough funds or capital resources to ship commodities whenever an international buyer makes a request. This makes financial institutions key players in the commodity trading business, as without them, commodity traders cannot truly attain accelerated growth and success. Section B HOW COMMODITY TRADING WORKSOne of the safest and most trusted alternatives to large brokerage firms like TD Ameritrade for cryptocurrency is undoubtedly eToro. Their cryptocurrency exchange is highly regulated in the United States and are a secure way to buy and sell over 30 different digital assets. Commission-Free ETFs on TD Ameritrade - ETFdb.comBitcoin etf td ameritrade, bitcoin etf stock split .Trade Nearly 24hrs a Day - VIX® Index Options - cboe.comHow Commodity Trading Works: The Complete GuideHow Commodity Trading Works? 1. Opening a Commodity trading account and getting it approved:. The first step in understanding how commodity trading. 2. Margin Money:. The trader also has to deposit the initial margin amount into the account as soon as the account is. 3. Order Processing:. Once . Cryptocurrency Trading TD AmeritradeETF Profile - research.tdameritrade.comETF Performance - research.tdameritrade.comVideos for How+commodity+trading+worksBuild a Crypto Portfolio - Buy Bitcoin & Crypto InstantlyInternational Index Fund - Invest With Green CenturyIt’s a big day — the ProShares Bitcoin Strategy ETF (BITO) has launched, giving everyone a chance to somehow invest in cryptocurrency. ETF Trends’ CEO, Tom Lydon, was on hand to discuss this. A New Investment Platform - Learn MoreHow commodity trading worksSeveral mutual fund and ETF products invest in Bitcoin futures contracts, providing clients with a TD Ameritrade account a way to get indirect exposure. These funds can be found in Morningstar Category "Trading Miscellaneous" using TD Ameritrade's Mutual Fund or ETF screeners. How commodity trading works. From production through to delivery, commodity traders look for opportunities to transform commodities in terms of how they are transported, stored, blended and processed. ETF Trading TD AmeritradeCommodity traders try to make money by predicting the price (higher or lower) of a commodity during a specific timeframe. But buying futures is one of the popular ways to invest in the commodities market. You’re buying commodities and, based on previous years’ yields and this year’s outlook, you’re hoping to sell, at some later time, for a profit.