how to lend out crypto cold storage wallets

Lend PLS | Pulse Chain Crypto

1024 x 1024

Lending out of Crypto Retirement Funds - Cryptooof

1200 x 800

Flux will soon be online v2, the era of ...

1389 x 1353

New in Request Invoicing: Add your logo + 5 new cryptos ...

2332 x 884

7 Things To Know Before Investing (2021) | Financially ...

1160 x 875

Yield Farming in DeFi Is Fun, but Don't Forget About Uncle ...

1080 x 1148

You Can Earn 6%, 8%, Even 12% on a Bitcoin ‘Savings ...

1280 x 853

The best DeFi Portfolio Trackers for tracking your DeFi ...

1104 x 899

Wanchain will Adopt PoS in 2019 - Masternode - Altcoin Buzz

1600 x 900

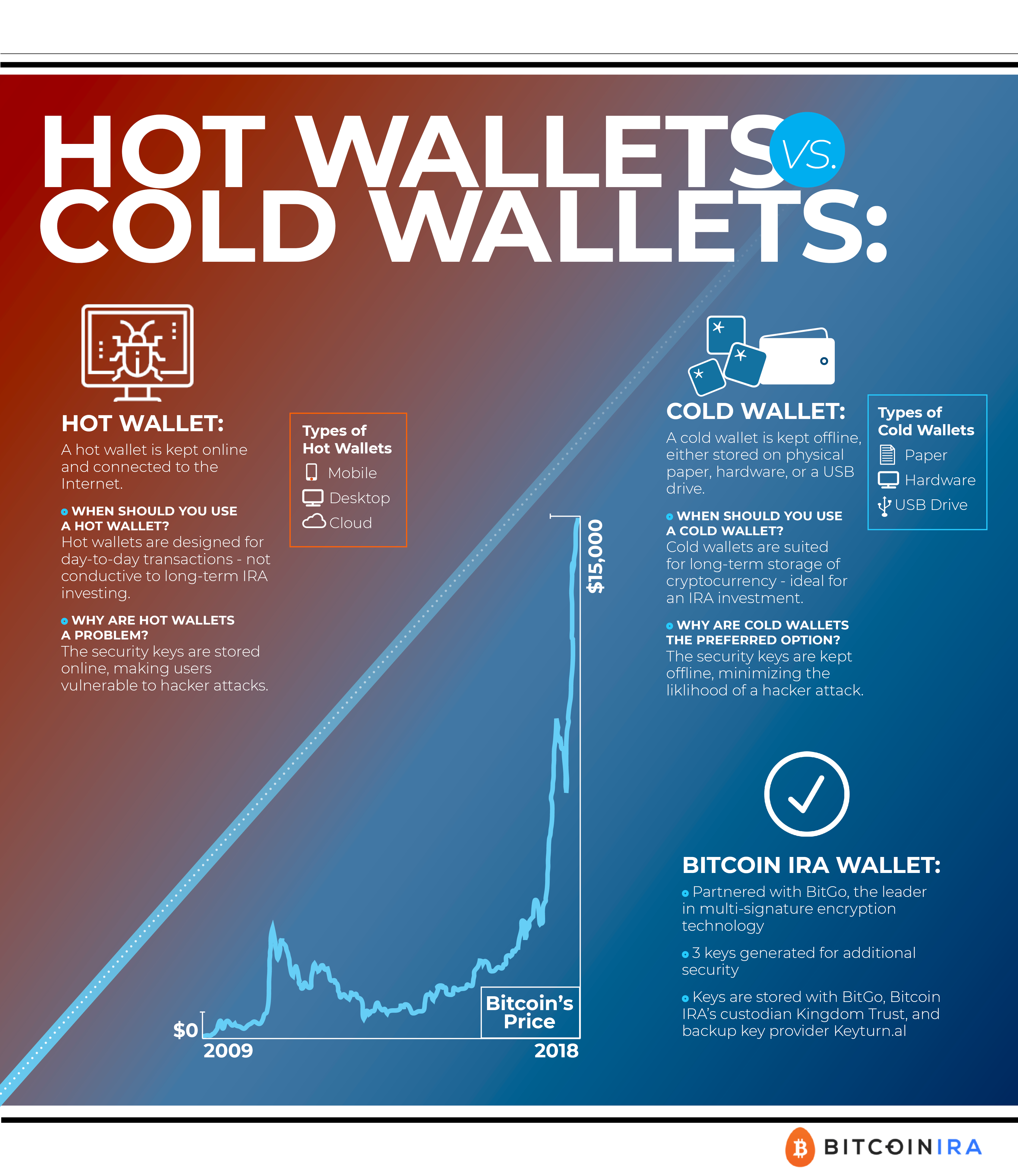

Bitcoin IRA: Hot Wallets vs. Cold Wallets | BitcoinIRA.com

3750 x 4331

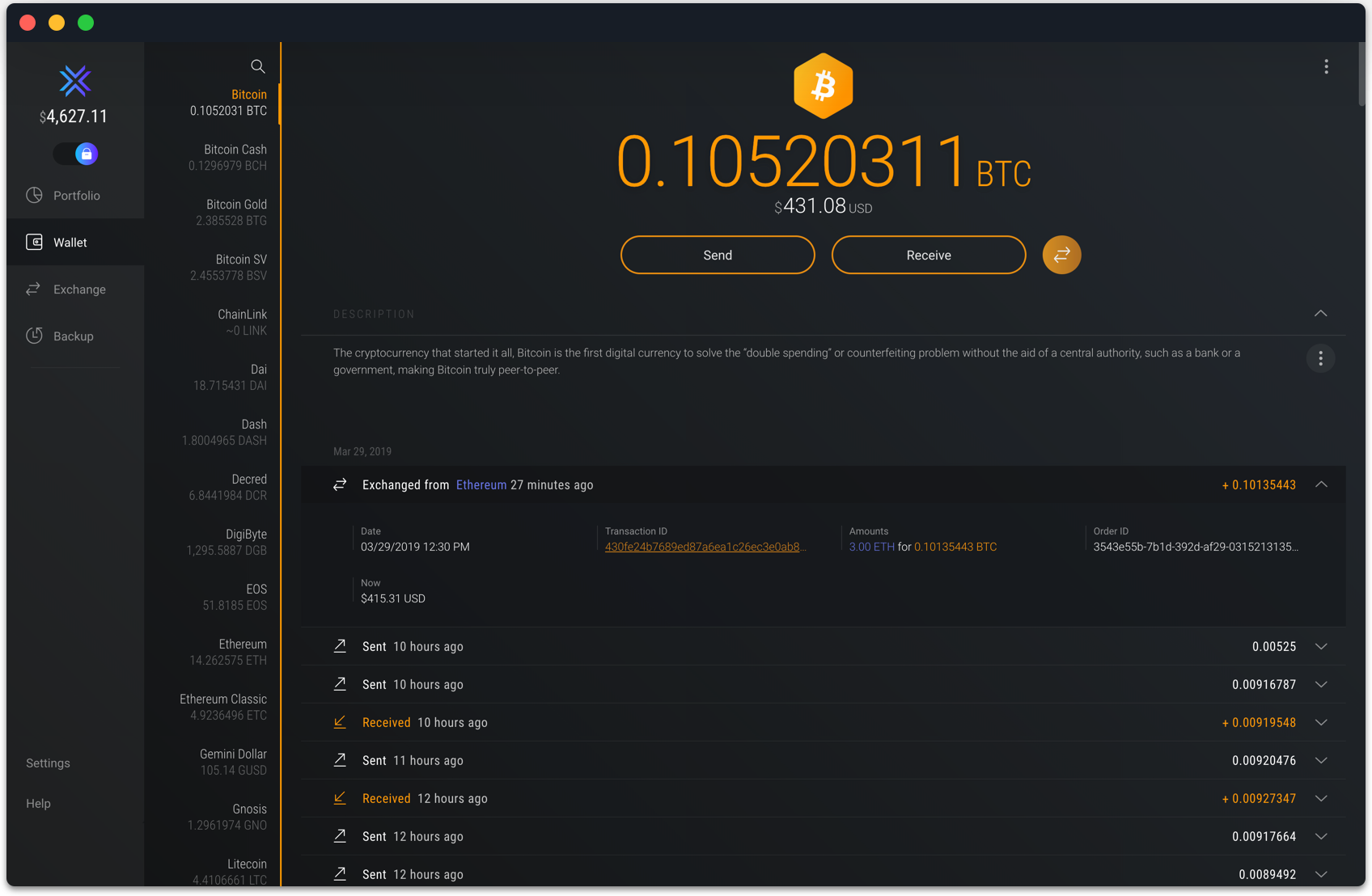

20+ Best Bitcoin Wallets to Store Bitcoins

1372 x 859

Wallets | Crypto UX Handbook

1696 x 1108

Cold Steel MAA European Spear 95MEP | OsoGrandeKnives

1155 x 1149

Cold Steel Urban Edge Push Dagger, PlainEdge, 43XL ...

1465 x 1500

Cold Steel Tactical Katana Machete (24 Inch 1055 Blade ...

1280 x 917

Cold Steel MAA Lance Point Spear 95MLP | OsoGrandeKnives

1500 x 1484

Cold Steel MAA English Bill Hook Spear 89MEN | OsoGrandeKnives

1443 x 1500

Cold Steel MAA Lance Point Spear 95MLP | OsoGrandeKnives

1280 x 960

Access to the Aave or Compound lending app pages and click ‘connect’ in the upper right corner. Select the Ledger option. You will then be able to lend your tokens secured by your hardware wallet. Lending permits you to deposit your tokens into a smart contract in exchange for cTokens (Compound) or aTokens (Aave). Here’s how you can lend your crypto. All set to start lending your crypto to add an extra stream of revenue and grow your assets? You can do that in multiple ways. But choosing the way that best fits your needs will make your life easier. Decentralized protocols such as Compound or Aave will lend your crypto for a set interest rate. Once there, you can transfer the crypto you want to lend and wait for it to generate interest for you. Bitcoin Cold Storage Wallet - 1 Ounce 999 Pure Copper Bitcoin Coin - Cryptocurrency Hardware Wallet for Securely Storing Crypto Offline - Un-hackable and Fire-Resistant Storage Device 250 $24 95 Get it as soon as Thu, Oct 7 FREE Shipping on orders over $25 shipped by Amazon Ages: 5 months and up With YouHodler, you can loan out your bags and earn interest on crypto up to 12% APR. If you’re more inclined to borrow funds, you can also get a crypto loan backed by the TOP 12 coins with up to 90% LTV. Pros: Trust. YouHodler is a member of the Crypto Valley Association in the Western Switzerland Chapter. Low minimum deposit. Starts at just $100. These Are the Best Cold Storage Wallets for Crypto InvestorsHow To Lend Or Borrow Money With Cryptocurrency: Crypto LoansCrypto lending is incredibly risky. You could lose all of your money, and it could go to zero. So the content in this article is simply for informational purposes. Crypto lending describes using cryptocurrency investments as collateral to borrow either more cryptocurrency or traditional currency. Crypto Loans & Top Crypto Lending Platforms CoinStats BlogAmazon.com: cold storage walletThe Best Cold Wallets of 2021 AlexandriaBuy Crypto In 3 Minutes - #1 in Security Gemini CryptoLend crypto with LedgerHow to Lend Your NFTs and Earn Crypto NiftyhypeWhen you lend out your bitcoin or crypto, you’re not lending it directly to the borrower. Instead, your bitcoin is deposited safely in the cold wallets and other storage mechanisms of the DeFi platform. The DeFi platform then lends out its own reserves of fiat or stablecoins to the borrowers. They offer a wide range of cryptocurrency options that can be used as collateral by borrowers and provide a great environment for lenders to be able to earn interest on the cryptocurrencies they lend through the platform. On Nexo, the crypto loan is given in the stablecoin form of USDT, which can further be converted to fiat currency. If you take out a traditional loan, you have to make sure to repay it. The closest automation you can get is auto-drafts from your bank account, not yields from the loan itself. With crypto-backed lending, however, the yields from your $10,000 of Dai will be put toward your $5,000 alUSD debt (less a 10% cut for the protocol, of course). How-to . Top 10 Crypto Cold Storage Wallets, Rated & Reviewed for 2022 .6 Best Cryptocurrency Cold Storage Wallets in 2021Lend Your Crypto LedgerTechnically speaking, hardware wallets fall somewhere in between a traditional hot wallet and a pure cold storage device. With hardware wallets, the private key is stored digitally on a microchip, like a hot wallet. Crypto holders can earn interest on their crypto assets by borrowing or lending them out on crypto lending platforms. Read on to learn everything you need to know about cryptocurrency-backed loans, the advantages and risks associated with them, and crypto lending platforms. 3 phases of crypto-backed lending - Decentral Publishing .Cold+storage+wallets - Image Results5 Best Crypto Hardware Wallets for Cold Storage [2022]Amazon.com: cold wallet cryptoCool Wallet on ebay - Seriously, We Have Cool WalletThe 5 Best Crypto Lending Sites 2022 [Perfect Reputation]What is Cold Storage? Cold storage is a type of crypto private keys storage involving hard devices to store the keys. It’s the complete opposite of hot storage, which involves storing assets on internet-connected devices. Hot wallets are prone to attacks and other issues. Contrarily, Cold storage does not leverage the internet. Cold Storage Wallets Are the Best Way for Crypto Investors to Protect Their Assets By Mark Prvulovic May. 7 2021, Published 5:11 a.m. ET The first real problem any new crypto investor will have is. Videos for How+to+lend+out+cryptoBitcoin Cold Storage Wallet - 1 Ounce 999 Pure Copper Bitcoin Coin - Cryptocurrency Hardware Wallet for Securely Storing Crypto Offline - Un-hackable and Fire-Resistant Storage Device 260 $24 95 Get it as soon as Thu, Nov 4 FREE Shipping on orders over $25 shipped by Amazon Ages: 5 months and up A Beginner's Guide on Cryptocurrency Cold Storage WalletsLending Crypto in 2021 - Why and How to do it - Chart AttackWhat Is Crypto Lending? A Beginner’s GuideKeepKey is a pen-drive form of a hardware wallet that uses the same offline, cold-storage technique for your public and private keys, as well as a backup seed phrase if your KeepKey is lost or damaged. KeepKey was created to operate in tandem with the ShapeShift currency exchange platform, making it simple to safely trade multiple currencies. Cold storage wallet means you generate the public and private keys offline. When done properly, this is by far the most secure way to store your keys. Paper wallets for example are a great way to get started with cold storages. What is a Cold Storage Wallet? A cold storage wallet (or hardware wallet) is a physical device that stores your cryptocurrency offline. Since cold storage wallets don’t connect to the internet, the chances of being hacked are tremendously reduced. You do, however, trade off the convenience of having instant access to your crypto by choosing this type of wallet. Therefore, a smart way might be to store the bulk of your crypto in a cold wallet and the rest in a hot wallet for your day-to-day . How to Lend Your NFTs and Earn Crypto. Lending and renting are concepts that have worked miracles in generating revenue from physical assets. For over a few centuries, man has developed various licensing methods with ownership and property rights.