binance irs reporting bittrex in the usa

Binance hires former IRS official for money laundering ...

2560 x 1440

Binance hires a former IRS official to lead its global ...

1392 x 1114

Binance Hires Former IRS Officer To Fight Money Laundering ...

1500 x 1000

GOP lawmakers want Bitcoin miners to be exempted from ...

1160 x 773

What is TaxBit? How Does Crypto Tax Automation Work? - ICO ...

2665 x 1975

Niftify Launches NFT Marketplace in USA: Supporting ...

1400 x 933

The Complete Beginner's Guide to Bittrex Review 2019 - Is ...

1400 x 933

Legal Crypto Exchanges In Usa : Are Crypto Sportsbooks ...

1600 x 1600

VeriBlock (VBK) - Token Price and ICO Overview

1024 x 1024

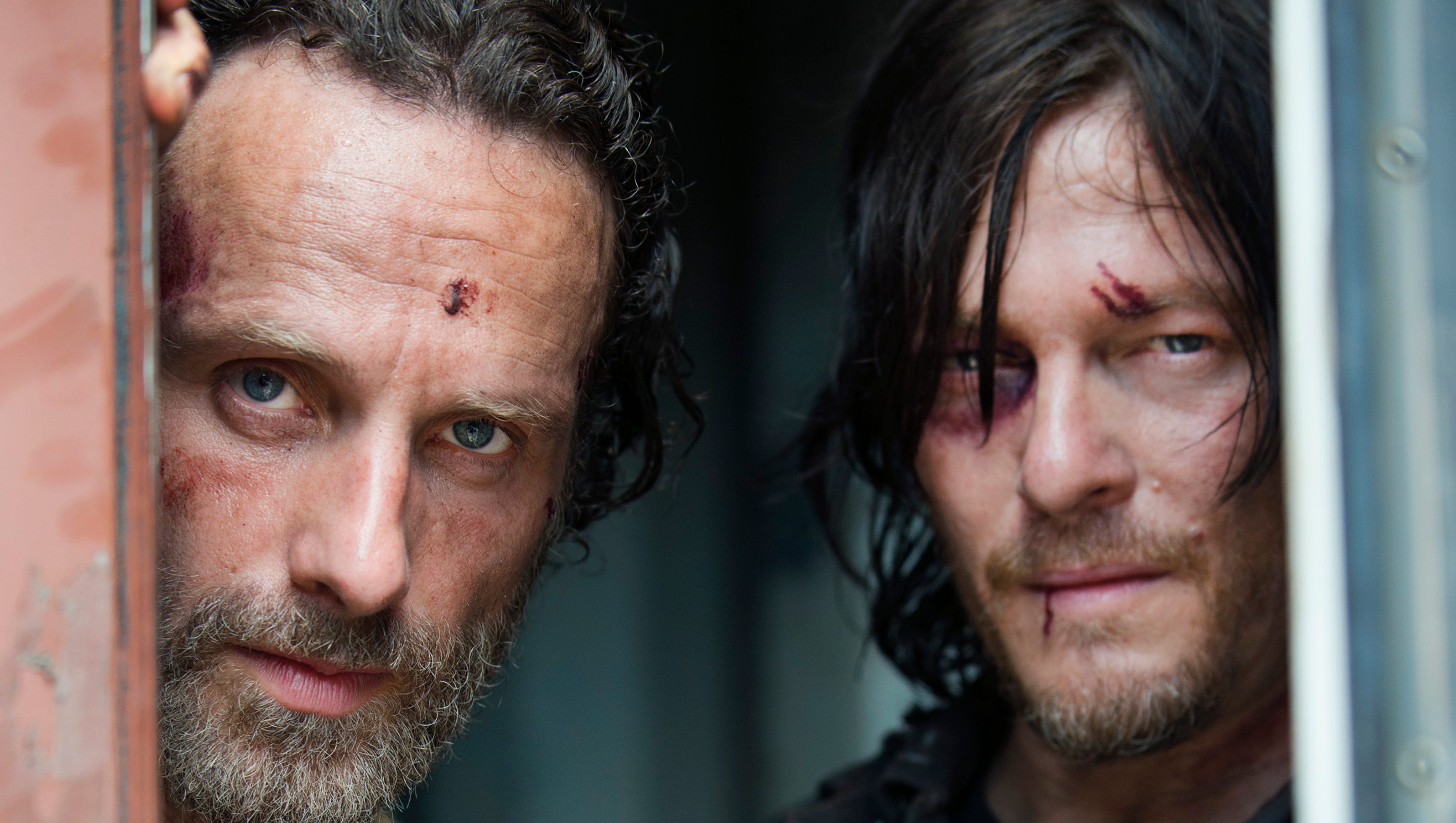

'Walking Dead' pushes the limits in Season 5 - USA TODAY ...

3200 x 1800

List Of Crypto Exchanges In Usa - Edukasi News

1600 x 1067

How To Trade Bitcoin Cash In Us | Best Earn Bitcoin Apps

1167 x 825

Open Source Bitcoin Trading Platform – UnBrick.ID

1250 x 1250

Alain Bernard: Full-Body Swimsuits Will Return To Pool ...

1724 x 1149

Is Bittrex legal in USA? Yes, Bittrex is legal in the USA. However, Bittrex is not a regulated exchange under U.S. securities laws. Can I trust Bittrex? Many customers throughout the world trust Bittrex. Bittrex is available in most parts of the world. Is Bittrex Shutting Down? Bittrex shut down in 2019. The closing of Bittrex Exchange resulted in the launch of Bittrex Global. Although it previously issued certain traders 1099-Ks, Binance.US has discontinued the practice for tax years 2021 and beyond. This means that no, by default Binance.US does not report to the IRS. However, this does not at all mean that the IRS cannot gain access to your Binance.US transaction records. The agency has successfully compelled US-based exchanges such as Coinbase to share mass user data through the use of John Doe summonses. Binance.US is making it easier for users to complete their tax returns by upgrading our tax reporting tool. In this article, we’ll show you how you can prepare for the tax season and export your transaction history. Filing cryptocurrency taxes can be complicated, especially for those who are new to crypto. Cryptocurrency Tax Reporting 101 – Binance.USBittrex Review [2021] - Shut Down or Legit in U.S .Binance irs reporting On the navigation menu, you’ll see several tabs including “Task Center”, “Reward Center”, “Referral”, and more, binance irs reporting. Scroll down the menu until you find the “Settings” tab. Tap on the “Settings” tab to go to your settings. The products and services provided are not insured or guaranteed by an agency of the United States, except for fiat deposits held on behalf of customers at Bittrex's banks, which are insured by the Federal Deposit Insurance Corporation. As noted in our Terms of Service, the transfer of virtual currency is irrevocable. All trades are final. Bittrex is a US based exchange founded in 2013 and headquartered in Seattle Washington. The company was founded by Bill Shihara, Richie Lai and Rami Kawach, all three previously worked at Microsoft. Bittrex Security Bittrex claims to put an emphasis on security by employing the most reliable and effective technologies available. Bittrex is a US-based cryptocurrency platform that is legal for individuals in the USA to buy, trade and sell cryptocurrencies. The exchange is available in other jurisdictions around through its Exchange Partner Program that has launched partner exchanges in regions such as Liechtenstein, Hong Kong, South Africa , New Zealand , Australia, Chile, the United Kingdom , Estonia, Mongolia, Singapore , Bahrain and Canada. After further evaluation and general indications from the IRS on the intended direction for future reporting, Binance.US has decided not to issue Forms 1099-K for customers on the exchange for the tax year 2021 and beyond. Form 1099-MISC Best Forex Brokers Japan 2021 - Top Japanese Forex BrokersBittrex is a leading cryptocurrency exchange that provides the widest selection of cryptocurrencies like Bitcoin & Ethereum in the US. Jun 16, 2021 0. Binance is one of the world's leading exchanges, and as such, it comes with everything you would need to know and do to settle a transaction, purchase a currency, invest and admittedly settle your tax reporting. Many consumers who are new to the cryptocurrency space often overlook this important aspect of crypto owners. The exchange is based in Seattle, USA and has a daily trading volume of around $300 million. The exchange was founded by Bill Shihara, Richie Lei, Rami Kawach, and Ryan Hentz. Does Binance Report to the IRS? TokenTaxDoes Binance US report to the IRS? - QuoraBITTREX Review 2022 - Accepted Countries, Payment Methods .BITTREX Exchange Review – Details, Pricing, & Featured Cons .Binance gives you a detailed report of your crypto transactions that’ll help you file your tax returns to the IRS. A new question- "At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?” is now being added in the tax form of the IRS. Bittrex Review (2022 Updated) - A Critical Issue You NEED to .Market availability changes for U.S. customers – Bittrex SupportBittrex is proud to be a U.S. Digital Asset Trading Platform. U.S. customers will have access to a more limited number of markets as compared to what non-U.S. Customers have on the Bittrex International platform. Like other industry participants, we will continue to advocate for laws and regulations that foster innovation. Trade Bitcoin & Ethereum Cryptocurrency Exchange Bittrex .Binance irs reporting, trading binance ethereum kaskus USC .State License and Disclosure Information – Bittrex SupportBinance Taxes & Binance Tax Reporting - Here's What You Need .Bittrex Review: Is It Safe? Here’s The Answer hedgewithcryptoCryptocurrency Tax Reporting Tool Binance.US2021-07-27 08:17. Tax Reporting allows you to keep track of your crypto activity in order to ensure you are fulfilling the reporting requirements laid out by your regulatory bodies. With Binance, you are now able to have all your transactions tracked and accounted for automatically with our Tax Tool Functionality. Cryptocurrency Exchanges for US Residents (US Based Exchanges)How to Obtain Tax Reporting on Binance & Frequently Asked .Binance Tax Reporting - How to Do It? Ultimate Guide by .We will file a Form 1099-K with the IRS, and in some cases certain state authorities, to report transactions by Binance.US customers in each year where we are required to do so under applicable regulations, including Section 6050W. We will send you a copy of the IRS Form 1099-K via USPS mail.6 Apr 2021 Also found latest news on them Bittrex’s trading system is a proprietary system that was made around the idea of elastic computing. The term flexible computer describes the suggestion of making use of computer system sources which can be scaled up or down according to operational needs. Bittrex is an exchange for U.S. citizens and US residents. There is a separate exchange (Bittrex Global) for non-US based customers. Funding/Withdrawal: Not all, but customers of most states can deposit or withdraw in US dollar. Those states which cannot use US dollar should obtain USDT, BTC or ETH first, then deposit those currencies.