buy coinbase ipo maker coinbase

юААCoinbaseюАБ юААIPOюАБ: 11 Things to Know as юААCoinbaseюАБ Files to Come ...

1600 x 900

2021 - юААCoinbaseюАБ юААIPOюАБ: юААCoinbaseюАБ starting price set

2560 x 1707

юААCoinbaseюАБ юААIpoюАБ Date : 1 Fintech Stock To Know юААCoinbaseюАБ Has A ...

1580 x 888

юААCoinbaseюАБ юААIPOюАБ: Which brokers are selling юААCoinbaseюАБ shares in ...

1800 x 1000

юААCoinbaseюАБ Unveils iOS and Android App Redesign

1597 x 781

DOGE on юААCoinbaseюАБ? Dogecoin Investors Bark for Inclusion ...

1600 x 900

юААCoinbaseюАБ Going Public Date | Adinasinc

3600 x 2396

юААCoinbaseюАБ юААIpoюАБ Members - Xj Nsoco Bx Wm - In the past, a ...

1500 x 844

юААCoinbaseюАБ юААIpoюАБ Webull : юААCoinbaseюАБ ╨┐╨╛╨┤╨░╨╗╨░ ╨╖╨░╤П╨▓╨║╤Г ╨╜╨░ ╨┐╤А╨╛╨▓╨╡╨┤╨╡╨╜╨╕╨╡ ...

1600 x 1150

юААCoinbaseюАБ тАУ Reviews, Trading Fees & Cryptos (2020 ...

2600 x 909

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto.com vs. юААCoinbaseюАБ: Which Should You Choose? тАУ Pakis ...

1500 x 1000

Hogyan ├║szhatod meg a юААCoinbaseюАБ kiutal├si d├нjait?

1361 x 841

Technical Description of Critical Vulnerability in ...

2400 x 1350

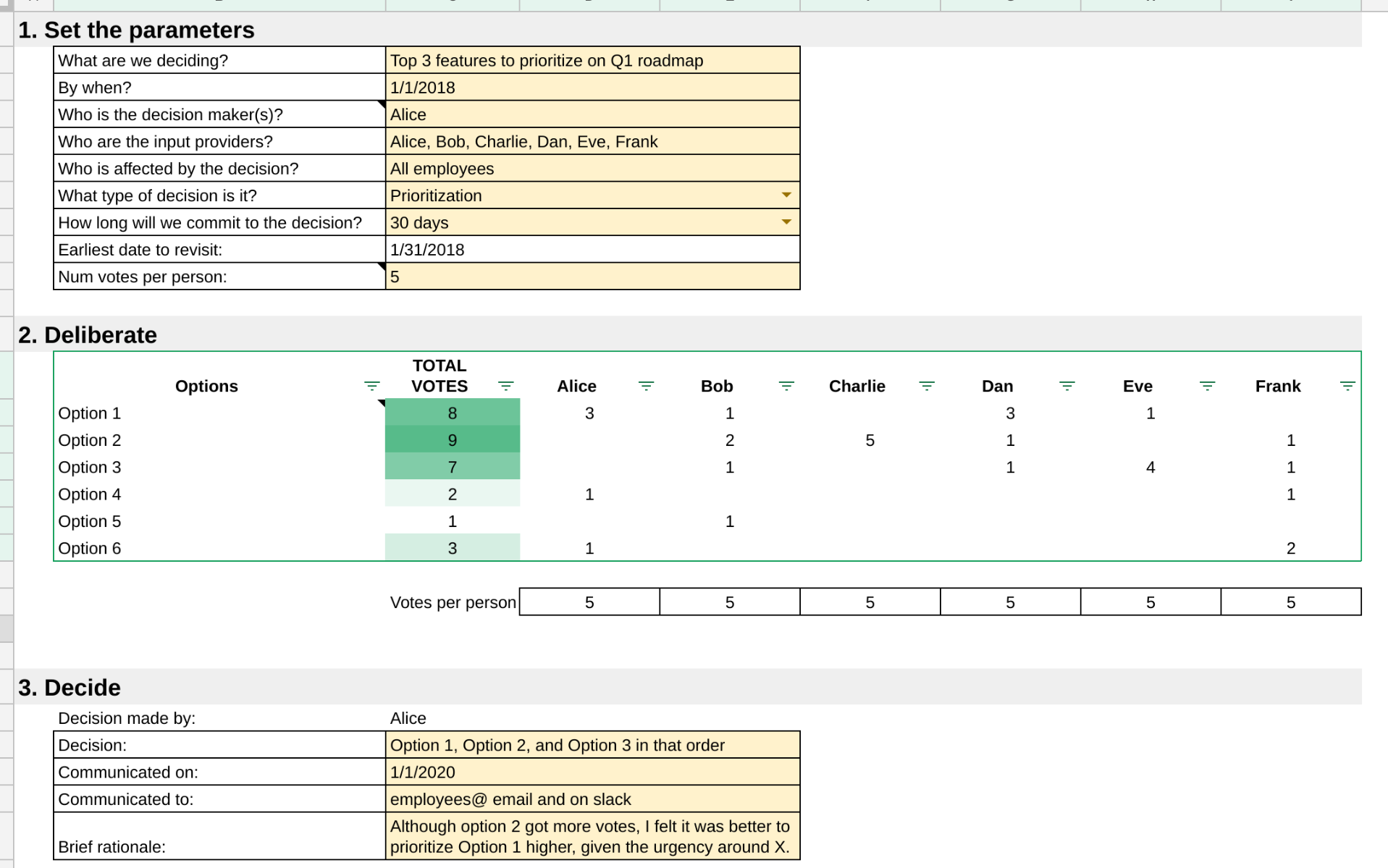

How we make decisions at юААCoinbaseюАБ | by Brian Armstrong ...

1917 x 1199

Why I DonтАЩt Use юААCoinbaseюАБ Wallet

1449 x 813

![Top 7 юААCoinbaseюАБ Alternatives [Comparison] - Crypto Pro](https://cryptopro.app/wp-content/uploads/2019/08/Kraken-Screenshot-min-1024x805.png)

Top 7 юААCoinbaseюАБ Alternatives [Comparison] - Crypto Pro

1024 x 805

Rates Changes Proposal 6 Jan 2021 - Updates - The юААMakerюАБ Forum

2136 x 1332

Videos for Buy+coinbase+ipoWhere to buy the Coinbase IPO Once Coinbase has its IPO, retail investors will be able to buy and sell the stock through their typical investment vehicle. As CNBC reports, Rodriques of Forge said. This Iconic Footwear Maker Passes Coinbase, Starbucks And Target In Apple App Store Ahead Of The Holidays. by Adam Eckert. November 23, 2021 5:46 pm. License. Coinbase December 2020 Market Maker Program by Coinbase .What Are Maker & Taker Fees? Explained For Beginners .1.91 Coinbase Pro and Coinbase Exchange charge a Maker fee for each Maker Order and a Taker fee for each Taker Order that is posted to the Order Book. The fee is charged in the Quote Asset and is calculated as a percentage of the Order quantity. Coinbase ICO - The Coinbase IPO CryptocurrencyHow Do I Buy CoinbaseтАЩs IPO? By April 14, CoinbaseтАЩs direct listing date, youтАЩll need to have selected a brokerage, set your budget, decided on the type of order you want to place (market or . How to buy Coinbase IPO stock Since Coinbase is a direct listing, there wonтАЩt be any pre-IPO allotment. You can buy Coinbase stock once it starts trading on Apr. 14 by placing an order through your. How to Buy Coinbase (COIN) Stock Right Now тАв BenzingaMaker vs. Taker in CryptocurrencyCoinbase is the largest U.S.-based cryptocurrency market тАФ and it will soon be a public company as well. Learn how to buy Coinbase IPO stock now. Maker (MKR) Price, Charts, and News Coinbase: maker crypto .Trading Rules - CoinbaseDid you know about coinbase IPO cryptocurrency? Here we have a detailed article whether an IPO is a good option in trading or not. Learn more! To buy some USDC, you can buy it straight from crypto exchanges like Coinbase in exchange for fiat currencies, or trade it for another cryptocurrency, such as Bitcoin. Then, you can swap your newly purchased USDC for FTXтАЩs tokenized Coinbase IPO stock. And voila! A tokenized piece of Coinbase CEO Brian Armstrong himself. Which piece will you buy? Coinbase Pro uses a maker-taker fee model for determining its trading fees. Orders that provide liquidity (maker orders) are charged different fees than orders that take liquidity (taker orders). Fees are calculated based on the current pricing tier you are in when the order is placed, and not on the tier you would be in after a trade is completed . What are the fees on Coinbase Pro? Coinbase Pro HelpShould You Buy the Coinbase IPO?Since its IPO, it has been one of the top performing stocks on the S&P 500 and is up over 4,000% in the last 17 years. What else should you know about buying the Coinbase IPO? Tune into this week . Maker (MKR) Coinbase HelpCoinbase IPO Set for April 14: What You Need To Know Before .Coinbase IPO: HereтАЩs What You Need To Know тАУ Forbes AdvisorThat is the gist of maker-taker fees and why they are a thing, the rest of this page weтАЩll use CoinbaseтАЩs GDAX as a model to further explore these concepts. Understanding Maker-Taker Fees Via GDAX. When your order isnтАЩt filled immediately, for example if you placed a limit order, maker fees are charged. Coinbase uses a flat fee model when buying or selling cryptocurrencies using fiat currency. Coinbase Pro is the advanced trading platform that uses a maker and taker system to determine the fees. The pricing model starts at 0.5% for both makers and takers, however, with increasing trade volume the maker fee becomes slightly cheaper. How to Buy Shares in Coinbase Before Its IPO - DecryptThis Iconic Footwear Maker Passes Coinbase, Starbucks And .Buy, Sell & Store Bitcoin - Buy Bitcoin & Crypto InstantlyCoinbase, the largest cryptocurrency exchange in the U.S., has announced plans to go publicтАФbut it will eschew a traditional IPO in exchange for a so-called direct listing. Should You Buy Coinbase IPO Stock Despite Its High Valuation?Coinbase Help Center; Getting started; Maker (MKR) Maker (MKR) What is Maker (MKR)? Maker (MKR) is an Ethereum token that describes itself as тАЬa utility token, governance token, and recapitalization resource of the Maker system.тАЭ The purpose of the Maker system is to generate another Ethereum token, called Dai, that seeks to trade on exchanges at a value of exactly US$1.00. Buy Crypto In 3 Minutes - #1 in Security Gemini CryptoHow To Buy the Coinbase IPO - Market RealistAt Coinbase, we are on a mission to create an open financial system for the world. Over time, Coinbase has improved our exchange experience by offering clients access to a growing number of efficient cryptocurrency markets. A key reason weтАЩre able to do so is the strong community of clients who act as тАЬmakersтАЭ of liquidity on our exchange. Maker (MKR) is now available on Coinbase by Coinbase The .Should investors buy the Coinbase IPO? In the long run, Coinbase looks poised to grow along with the crypto economy. But buying in at such a steep valuation carries obvious risks. Most investors. Coinbase customers can now buy, sell, convert, send, receive, or store MKR. MKR will be available in all Coinbase-supported regions, with the exception of New York State. Maker (MKR) Maker is an ERC20 token that describes itself as тАЬa utility token, governance token, and recapitalization resource of the Maker system.тАЭ The purpose of the Maker system is to manage another Ethereum token, the DAI stablecoin, that seeks to trade on exchanges at a value of exactly US$1.00. 2 Reasons the Coinbase IPO Is a Risky Buy The Motley FoolMaker is an Ethereum token that describes itself as тАЬa utility token, governance token, and recapitalization resource of the Maker system.тАЭ. The purpose of the Maker system is to generate another Ethereum token, called Dai, that seeks to trade on exchanges at a value of exactly US$1.00. Resources. Videos for Maker+coinbase