fidessa oms trading system mina crypto currency

Anvil e-Trading - ION

1400 x 839

Back-End System Tester (BEST) – Allied Testing

1200 x 880

ION Anvil Trade Processing | Simplify and automate your ...

1400 x 839

Longview Trade Order Management System « Händler für ...

1913 x 993

FlexTrade Increases Sell-Side Sales Presence for EMEA ...

3072 x 4608

Institutional Equities Trading Solutions | Liquidnet

2500 x 1458

What's the difference between an EMS and an OMS?

1600 x 887

FlexTrade Increases Sell-Side Sales Presence for EMEA ...

3072 x 4608

Lak Loi and Vahid Shirani join FlexTrade's team as Vice ...

1916 x 1914

Institutional Equities Trading Solutions | Liquidnet

2500 x 1458

Institutional Equities Trading Solutions | Liquidnet

1600 x 1068

Institutional Equities Trading Solutions | Liquidnet

2500 x 2326

Ataque a p�ginas gubernamentales sirve de mina para ...

4147 x 2955

Crypto.com App Lists Mina (MINA)

1600 x 800

Blockchain gold: Gold-backed digital currency announces ...

1440 x 1109

Buy ‘crochet’ with Bitcoin Crypto-Currency – Spendabit

2000 x 2000

Símbolo De Moneda Del Mundo Foto de archivo libre de ...

1300 x 1390

Sec Filings Defined - Ella Scholten Coiffure

2048 x 1536

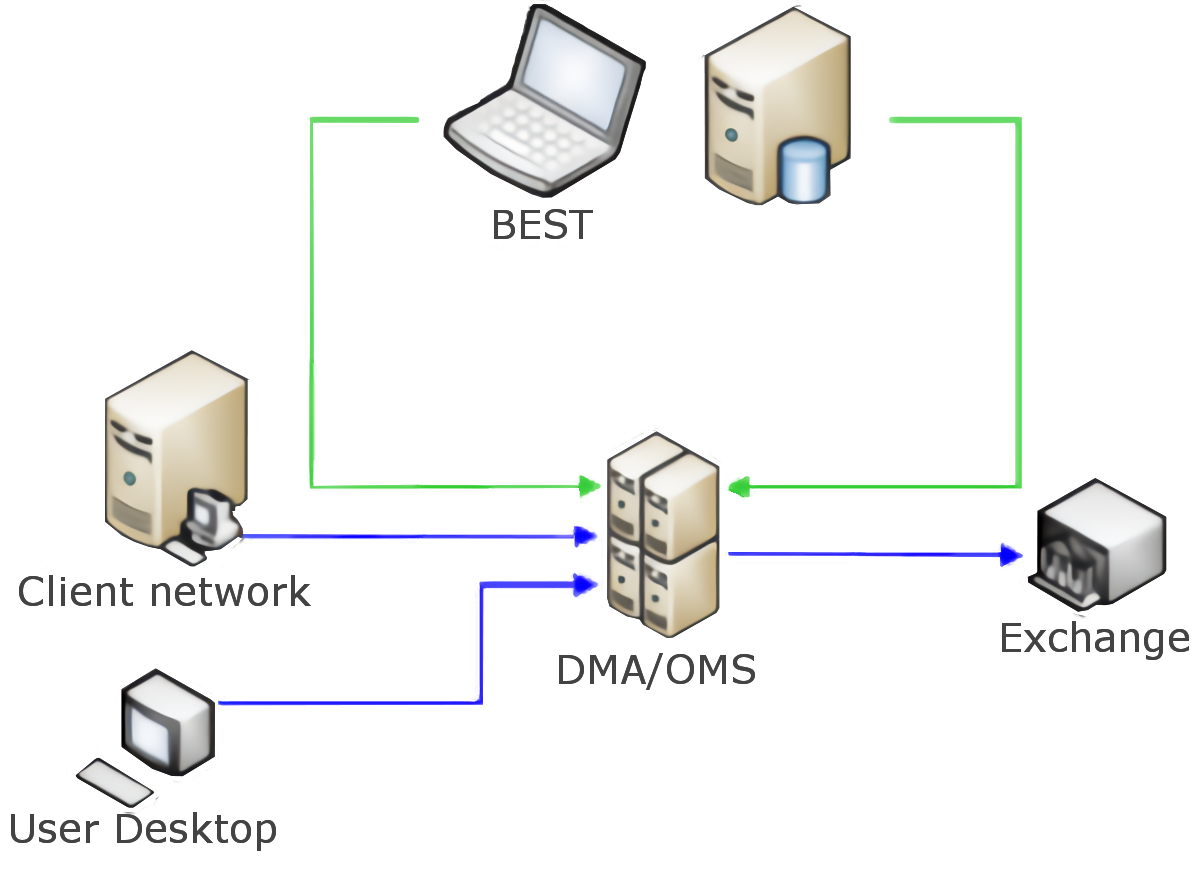

order management system (OMS), which helps streamline post-trade capabilities across all asset classes, among other functions, according to a Fidessa statement. ADVERTISEMENT Minerva is part of the group’s existing Investment Management Solutions suite, catering to asset managers – the system itself also targets end-to-end workflow methodology for investment decisions, compliance, orders, and trading. August 14, 2007. In April, sellside order management system vendor Fidessa bought LatentZero, an aggressive purveyor of buyside systems for large asset managers, for $126 million. The acquisition surprised industry watchers. In recent years, London-based Fidessa has forged deep inroads into U.S. broker-dealer territory traditionally dominated by SunGard’s Brass OMS, while LatentZero focused on the buyside. Mina Protocol: Is MINA Worth it? What you NEED to Know!!Mina Protocol (MINA) live coin price, charts, markets & liquidityMINA is a digital currency or digital token that represents mining power and the MINA holder’s stake in the MINA token. How does MINA work? The MINA Token Pool is a growing collection of many different tokens that have been mined from the blockchain or purchased at deep discounts. Mina is building a gateway between the real world and crypto — and the infrastructure for the secure, democratic future we all deserve. By design, the entire Mina blockchain is about 22kb1 – the size of a couple of tweets. So participants can quickly sync and verify the network. SEE BEHIND THE TECH. Mina Protocol (MINA) is currently ranked as the #87 cryptocurrency by market cap. Today it reached a high of $3.57, and now sits at $3.34. Mina Protocol (MINA) price is down 6.13% in the last 24 hours. Mina Protocol's ICO launched on April 12th 2021 and ran until April 12th 2021. The campaign raised $48,150,000. Mina (MINA) Search Trends. There is a correlation between price appreciation and public interest in cryptocurrencies, such as Mina. Many cryptocurrency investors use Google Trends, which measures the volume of web searches for a particular topic over time, as a tool to gauge whether public interest is increasing or decreasing for a particular cryptocurrency. Fidessa – Fidessa OMS - The TRADEMina Protocol is a cryptocurrency with a succinct blockchain storage and verification mechanism, which limits and maintains the total blockchain size consistently. The Mina Protocol was rebranded from the Coda Protocol in September 2020, and was created by O (1) Labs in 2017 with the goal of making cryptocurrencies more user-friendly and . Block trading venue Squawker has announced that Fidessa's sell-side order management system (OMS) has been connected to its systems. Fidessa Links OMS to Squawker - WatersTechnology.com Home Data Management Front-Office Tech Back-Office Tech Emerging Technologies Buy-Side Technology Regulation Awards Events Awards White papers Webinars Research Videos for Mina+crypto+currencyFidessa - WikipediaWhat is Mina? Investors warned about 'wild price swings' in .Fidessa Unveils Sentinel Trading Compliance SolutionMina Protocol The World's Lightest Blockchain ProtocolFidessa Links OMS to Squawker - WatersTechnology.comMina price today, MINA to USD live, marketcap and chart .2. Mina is a new cryptocurrency on the market - but investors are being warned of price swings Credit: Mina Protocol. Investors looking to put cash in cryptocurrencies need to be aware that they, like any investment, are a risky business. Making money is never guaranteed and you should make sure you can afford to lose the money you put it in. OMS Vendors Eye the Buyside - Traders MagazineProduct/Service Description. Fidessa’s Minerva consists of several components that altogether cover the entire trading cycle. Minerva OMS, EMS and Connectivity offer comprehensive, end-to-end workflow covering all asset classes with integrated compliance and connectivity to a global community of brokers and venues. Build a Crypto Portfolio - The Safest Place to Buy CryptoFidessa Rolls Out Minerva Upgrade, Opens New North American .Fidessa’s buy-side OMS is capable of global order routing, supporting multiple, disparate trading desks from a single, central installation. The system can be installed standalone or integrated with third-party portfolio management systems, quantitative models and other trading tools. Functionality includes order handling, allocations, commission Fidessa Fidessa The EMS Workstation is a broker-neutral, internet-deployed, low-latency trading workstation that supports equities and listed derivatives across global markets. Among other features, the system allows users to execute block orders and programs across multiple destinations and monitor fills and average prices in real time. It has a circulating supply of 341,058,118 MINA coins and the max. supply is not available. If you would like to know where to buy Mina, the top cryptocurrency exchanges for trading in Mina stock are currently Binance, OKEx, HitBTC, Gate.io, and DigiFinex. You can find others listed on our crypto exchanges page. Fidessa introduces new Sentinel Trading Compliance system .Fidessa group Holdings Ltd, is a British-headquartered company which provides software and services, such as trading and investment management systems, analytics and market data, to buy side and sell side clients in the financial services sector. It was listed on the London Stock Exchange and was a member of the FTSE 250 Index before it was acquired by ION Investment Group, which also owns financial content provider Dealogic and financial media group Acuris. Fidessa laos claims that “the system enables asset managers to centralize the monitoring and control of their trading operations across multiple systems, markets and trading desks for the very first time. Providing a pre-trade API, the solution is completely OMS-agnostic and comes together with an aggregated, post-trade monitoring suite.” Minerva OEMS Financial ITMina Crypto Price Prediction, News, and Analysis (MINA)Fidessa has forged a partnership with a major asset management client and has developed the new Sentinel Trading Compliance system. Richard Hooke, Buy-side Product Director at Fidessa, commented: “Monitoring and controlling trading activity has traditionally been handled by the OMS, but for many large asset managers this approach has become fragmented, difficult to control and insufficient. Fidessa - The TRADEMina