understanding binance etoro dividend tax

BNB coin Burn and How Does it Affect the Exchange rate?

1536 x 864

These 2 Exchanges Overtook Binance on CoinMarketCap ...

1706 x 1137

Inside The Race To Construct The World’s Fastest Bitcoin ...

1536 x 1100

Listing of TrueUSD (TUSD) on Binance is postponed

1600 x 844

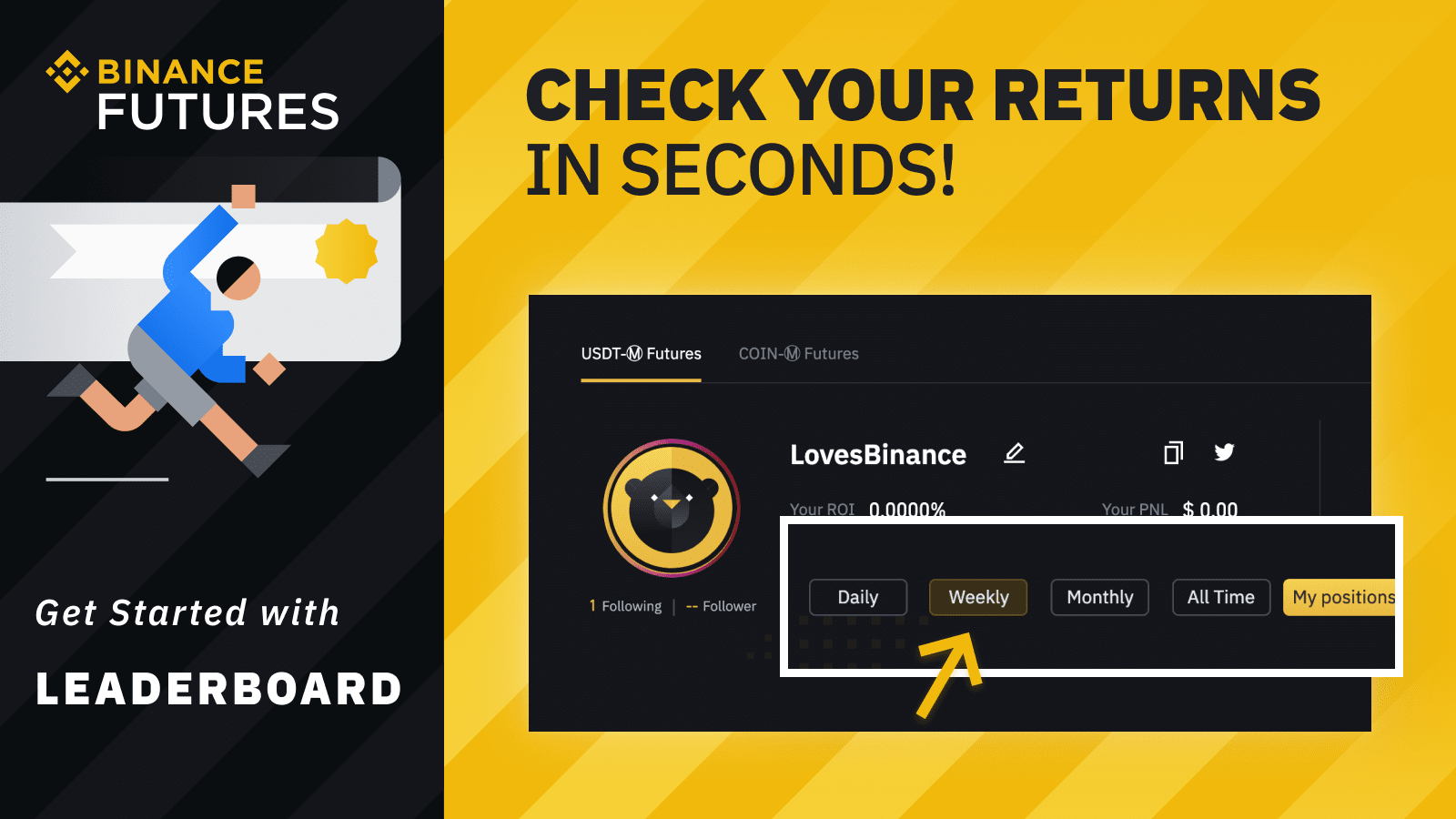

A Top Trader Made Over $700,000 On Binance Futures Last ...

1600 x 900

MemePad Looks to Capitalize on Hype Through an IDO ...

1600 x 899

Education: Guide To Understanding Candlestick

1748 x 2480

Guide to Crypto Derivatives: What is Cryptocurrency ...

1024 x 768

How To Trade Btc Eth Pair

1280 x 1280

Severn Trent share price: Water utility sees pre-tax ...

1568 x 1045

Binance Beginners Guide Binance SupporteToro Dividends: How They're Paid & How To Maximise (2022) GuideFind Out How to Use Binance: The Complete Binance TutorialDoes eToro pay dividends? Yes, we do. Your account may be either credited or debited if you are trading a stock, ETF or index that pays a dividend . If you hold a BUY position, you will receive the dividend payment to your available balance. If you hold a SELL position, the dividend payment will be deducted from your available balance. Binance explained (A beginner's guide to getting started .Newbie Quest: Understanding Binance Coin (BNB)Binance is an exchanged used by millions of people around the world. Furthermore, is a complex exchange, but easy to use, that offers to the users everything. Broadly speaking, this is the story of BNB, as I understood it. Receiving a dividend payment is a taxable event in some cases and jurisdictions. The percentage of tax withheld by eToro depends on various factors and differs from case to case. Dividends paid on US stocks and ETFs. In general, the withholding tax rate for a cash dividend paid by a US corporation is 30%. In cases where effectively connected income (ECI) is paid, the tax rate is 37%. With Binance options, users are not constrained to holding long-term positions. It caters to active traders who focus mainly on price action, rather than the long-term fundamentals of Bitcoin. This style of trading attempts to profit from quick moves in market prices and volatility. 2. With eToro you can earn dividends on a wide range of financial instruments including stocks, ETFs and even CFDs. You can get started for just $200, or for free with a demo account. Dividends Tax In some instances, receiving a dividend payment is taxable depending on the laws of your country of residence. Dividends: What is a Dividend & How Do They Work? eToroDoes eToro pay dividends? - Help CenterDividend calendar — upcoming dividend payouts- eToroDetails for Understanding Binance Charts and Related QueriesNo Money to Pay IRS Back Taxes - Qualify for IRS Fresh StartGutscheine Review 2021 - Get a 20% Fee DiscountAsk a Tax Advisor Online - Ask a Verified Expert Online.Dividend Tracker - Ex-Dividend Date CalendarBuy Etoro Stock - Invest in the Private MarketFor dividends paid on US stocks and ETFs, the withholding tax rate is usually 30%. In cases where the payment can be considered effectively connected income ( ECI ), the tax rate is 37%. For dividends paid on non-US stocks and ETFs, the percentage of tax withheld depends on the laws of the source country. How much tax is deducted from my dividends? - Help Center - eToroBinance one of best cryptocurrency trading platform and it was launched in July 2017. Why is it growing so fast? Binance is growing rapidly due to a number of reasons: a slick user interface, multiple languages and fast transactions. Many of the largest coins, after their ICOs, are being listed here. How to get set up . Step 1: Go to Binance Website World-Class Security - Get Started for Free TodayBinance Exchange Definition - InvestopediaBinance is a crypto-to-crypto exchange. This means that users can only use it to trade cryptocurrencies. If you don't already own some cryptocurrency, then you'll need to buy some before you can start trading with Binance. I suggest using an exchange that offers fiat currency trading like Coinmama, CEX.IO or Coinbase. More › See more result ›› The Complete Binance Tutorial For Beginners! ₿₿₿₿₿Register For Binance Here: https://www.binance.com/?ref=11610125If you are looking for a complete Binance . Monthly Dividend ETF - 7% Target Distribution Rate - forbes.comThe Complete Binance Tutorial For Beginners - YouTubeeToro and your tax return. Thousands of questions about the .BNB powers the Binance ecosystem and is the native coin of the Binance Chain and the Binance Smart Chain.BNB has several use cases, such as paying for trading fees on the Binance Exchange and Binance DEX (Decentralized Exchange), and paying for goods and services online and in-store. Binance Options: Understanding Options Prices Binance BlogSince eToro is the buyer of the values, it is also eToro that is liable for paying the withholding tax on receipt of dividends in the respective country.eToro forwards the dividends to us minus the. Binance is an online exchange where users can trade cryptocurrencies. It supports most commonly traded cryptocurrencies. Binance provides a crypto wallet for traders to store their electronic. We’ll run you through the basics of tax on dividends in the UK. Do You Pay Tax on Dividends? Dividends are taxable in the UK. Everyone has a tax-free dividends allowance. The dividend allowance for 2020/2021 was £2,000. This means you don’t pay any tax on the first £2,000 of income you derive from dividends. Anything outside of the dividends allowance is taxable. However, the good news here is that the dividend tax rate in the UK is lower than what you’ll pay on other earnings. Binance is a crypto-to-crypto exchange. This means that users can only use it to trade cryptocurrencies. If you don’t already own some cryptocurrency, then you’ll need to buy some before you can start trading with Binance. I suggest using an exchange that offers fiat currency trading like Coinmama, CEX.IO or Coinbase.